BY GARY EDMONDSON

I love hiking the Black Hills. I check the Rapid City Journal regularly to keep abreast of Hills happenings.

Still, it was a tip from The Lost Ogle website recently that led me to that rarest of specimens: a politician admitting a mistake.

More surprising, said politician was an Oklahoman. Mustang Republican Rep. Leslie Osborn, who is now running for Labor Commissioner, was taking her share of the blame for the budget bungling plaguing our state.

In a guest commentary for the Rapid City Journal, Rep. Osborn begins:

“In 2012, I helped author a bill to enact triggered income tax cuts … The bill became law. Five years later, I find myself spending most of my time as a state legislator trying to clean up what I had a large hand in creating.

“Since we enacted the tax cuts, Oklahoma hasn’t experienced the promised surge in economic growth. What we have experienced are large, persistent shortfalls that have led to drastic cuts to K-12 education and other vital state services.”

Osborn’s public excuse is that Oklahoma Republicans were clueless about the volatility of the state’s boom-or-bust oil business.

“I truly believed at that time that we needed to pass the tax cut,” she writes.” I now realize we didn’t have all the information we needed to enact successful tax policy.”

That lack of information can prove troubling – unless you fantasize your own “alternative facts.”

I guess she hopes South Dakotans lack the information that our boom/bust cycle is as predictable as severe droughts every 20 years or so. Maybe they are unaware, too, that Oklahoma Republicans reside within the pockets of oil industry lobbyists.

[And don’t overlook her admission that Oklahoma tax cuts failed to deliver their promised economic growth. Other hucksters preach those same lies today.]

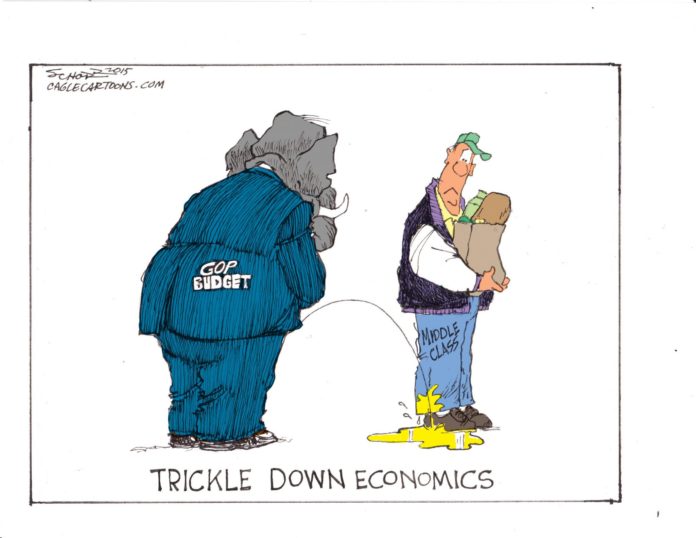

The current Republican-controlled Legislature tried steamroller into law “protect the rich” revenue projects promulgated by Step Up Oklahoma OKligarchs before most people had a chance to assess their ramifications.

We do know that a $1.50 per pack tax increase on cigarettes would see the poorest 20% of us picking up the biggest part of the tab for state government.

The additional 6 cents per gallon tax added to our gasoline costs would also hit lower income folks hard. Mileage allowance?

But what about that proposal to minimally increase the gross production tax?

As documented by The Oklahoman, the Stomp the Poor plan would have “raise[d] the starting gross production tax for all wells currently taxed at 2% to 4% and raise the starting gross production tax for all future wells to 4% for 36 months and then tax at 7%.”

With my oil and gas royalty netting me about $50 a year – about 25 times more than my writing royalty – I’m not well-versed in production practices. But I’ve been told that our frackers, with their horizontal drilling, can drain most of their wells well before their three-year deadline to pay reasonable rates.

Furthermore, drilling a new well nearby would pay for itself in short order, establishing another three-year cushion.

Rep. Osborn’s column was in response to the proposal for tax cut triggers in Nebraska, and she had earlier discussed the Oklahoma mess on a conference call with Nebraska media arranged by Open Sky Policy Institute.

“I am convinced that there is simply no way to account for everything you would need to know to create a safe tax-cut trigger that would only reduce taxes when it makes sense to do so. There is no way to predict or account for all the state, national and global economic factors that play into a state’s revenue stream.”

She then blames Iran for flooding the oil market and rendering state projections obsolete without adding the obvious corollary that the particular black swan appearing to bust the oil business is as irrelevant as it is predictable.

“The free-fall in the price of oil had a tremendous negative effect on our state’s economy,” Osborn said. “However, because of the parameters we set in our tax-cut triggers, we cut taxes right as the economy tanked …

“Tax-cut triggers tie our hands as policymakers. They prevent us from making decisions in real time, and with the information we need to make policy choices that best serve our state and our constituents. Why would we use triggers, when every year we can make tax changes using current data that reflects the current state of affairs in our state?”

My questions are, why were legislators again pushing bills toward law without taking proper time to examine them? Are they so dependent on the funding of the OKligarchs who support them that they welcome their marching orders regardless of how subservient it shows them to be?

We dodged the bullet on the first round of Step Up voting Feb. 12. Ten Democrats voted with the OKligarchy.

Predictably, since they can’t get poor people to pay for state government, the GOP failureship is now targeting poor people’s programs for massive cuts.

Ah, those compassionate conservatives.

– Duncan resident Gary Edmondson is chair of the Stephens County Democratic Party Chair