BY SHARON MARTIN

Two things: why are taxes so hard to figure and what do we get for our money?

Two things: why are taxes so hard to figure and what do we get for our money?

Ted Cruz wants to abolish the IRS and let us do our taxes on a postcard. How do businesses, from small operations to multinational corporations, show their profits and losses on a postcard?

I agree with Sen. Cruz that tax preparation should be simpler. But since there are millions of taxpayers, who exactly is going to handle all the tax forms without the IRS?

Imagine some file clerk in the Treasury Department sorting through several million postcards.

Who receives the tax payments? Perhaps he has in mind that his banking buddies can handle it, skimming a bit off the top, of course.

Every year, the tax code changes. Every year, preparers have to be trained and have to buy new computer programs to incorporate the year’s loopholes. Are loopholes necessary? If so, why?

Then there are the flat-taxers. Thomas Jefferson, for all his obvious faults, understood that a progressive tax system was necessary if his new republic would survive. Having those who earned more pay a higher rate and imposing taxes on huge bequests would keep the new United States of America from becoming another aristocracy, ruled by those with the money. Inheritance, not hard work, most often determines wealth in this country.

The moneyed elite in America have brainwashed too many workers into believing that a flat rate is fair. Just because you call it fair doesn’t make it so, unless you believe kings and nobles on one side of the equation and serfs on the other side are fair.

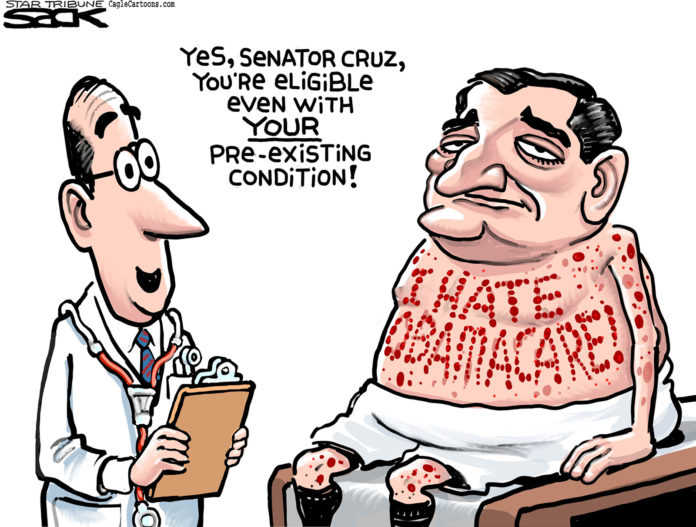

And what do we, the people, get for our tax dollars? Sen. Cruz is clearer on what we don’t get. Affordable health care is out of the question. He was willing to squander millions and shut down the government to keep our healthcare system antiquated and overpriced.

The ACA isn’t the best solution, but it’s the best one we have right now. Even better would be universal Medicare. How about it, Candidate Cruz?

Taxes are the price we pay to live in a civilized society. Everyone pays and everyone receives the benefits.

Take education. It doesn’t matter if you have children in the system; an educated population is good for everyone. So is a healthy population.

Imagine how much more earnings would be taxable if most of us were healthy and educated. We could get there with a simplified tax code and with everyone paying a fair share.

– Sharon Martin lives in Oilton, OK and is a regular contributor to The Oklahoma Observer