BY JANET E. NEW

Dear Gov. Fallin:

April 27, 2017 the Oklahoma Senate passed HB1913, the “Oklahoma Small Loan Act,” by a vote of 28-16. This action following approval by the Oklahoma House of Representatives March 13, 2017 by a vote of 59-31. I had previously written to my senator, Kyle Loveless, and my representative, Chris Kannady, author of HB 1913, about my concerns. Though Rep. Kannady extended the courtesy of a reply, he did not specifically address the issues, subsequently voiced by many others, including the AARP, Catholic Charities, Oklahoma Women’s Coalition, Oklahoma Conference of Churches, and Oklahoma Policy Institute. Additionally, there were statements and letters signed by over 100 clergy and various denominational leaders and several strong editorials opposing the predatory lending practice of a 17% per month interest rate provided in the bill.

You often speak proudly of “The Oklahoma Standard,” and that phrase represents the care we exhibit for Oklahomans who have experienced the devastating effects of disasters, but in a more general sense, it also represents the compassion and care we exhibit for fellow Oklahomans who are in need, sickness, or other adversity. It speaks to our values as human beings. What does it say about us if we codify a law that allows a branch of the financial services industry to charge Oklahomans a 17% per month interest rate on a small loan?

In years past, I’ve assisted family members and others with understanding the problems associated with high interest, “payday” loans and working their way through repayment to a better place. I’m concerned about the state of Oklahoma enabling this practice through legislation. I understand there are currently $1,500 loans available at high, but more favorable interest rates than those sanctioned by this bill.

Certain senators defend HB1913 as a better alternative to tribal, off-shore or online lending practices. They point to Section 2. 6. [a-d] and Section 11. B. and C. as affording additional protections for the borrower by 1] limiting the principal amount to $1,500 and the term to one-year; 2] establishing equal periodic payments; and 3] improving financial literacy by clearly revealing all loan terms and fees. These senators also point out that such a small loan would enable a “woman without the necessary savings, to replace an $800 refrigerator using this small loan,” and that such an individual would “be protected” by loan limitations. These arguments are red herrings, designed to distract from the exorbitance of the interest rate – in this case, raising the price of the refrigerator from $800 to a total repayment of $1,924 – at an annualized interest rate of 204%!

How can codifying a usurious law like this ever meet the “Oklahoma Standard” of caring compassionately for the least fortunate of our Oklahoma neighbors? The businesses it rewards are the 650 loans companies not otherwise excluded from participation in the program under Section 3.C. of HB 1913.

These new, small loans will negatively impact people who are already insolvent and therefore captive to such financial alternatives – people with health needs and no insurance or people coming out of prison with significant fines, fees and other expenses. In short, should the state of Oklahoma [or any state] be in the business of enabling excessive gain by one sector of the financial services industry at the expense of the average Oklahoman. While Sen. [James] Leewright indicated the Consumer Financial Protection Bureau [CFPB] was considering the elimination of other payday loans, Sen. [Micheal] Bergstrom informed the Senate that there was significant industry opposition to eliminating other payday loans. If other loans will continue to be available at higher but more reasonable rates, there is no compelling need for this new extortionate loan.

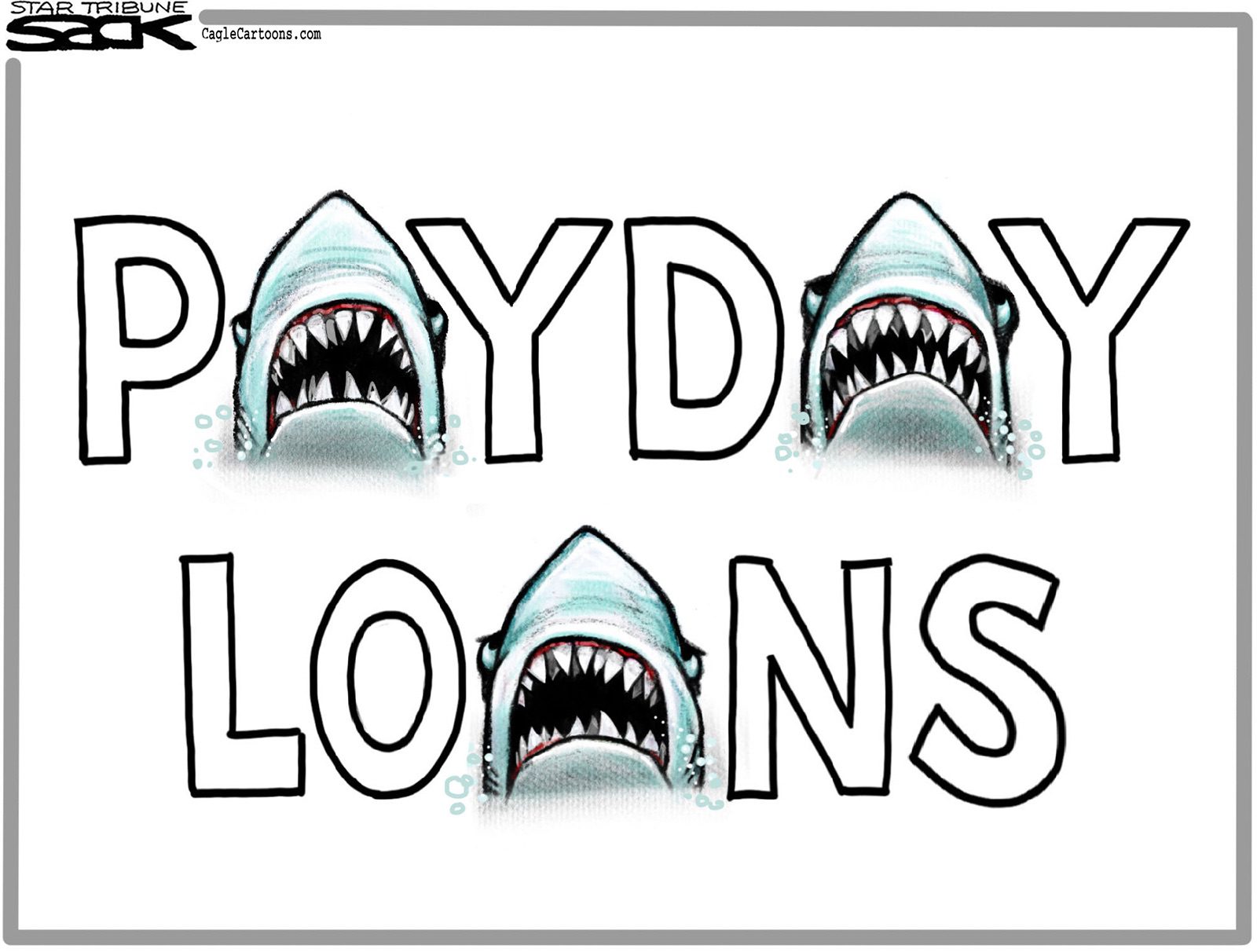

Additional concerns are also reflected in the pejorative comments appended to a Tulsa World article that appeared in March. In it, Rep. Kannady was quoted by Randy Krehbiel as saying, “I don’t like this type of loan any more than you do,” but went on to say the bill was an “an improvement on current law and better than sending desperate borrowers to unregulated loan sharks.” Even if some consider a 204% annualized interest rate better than other financial alternatives, it’s difficult to see how Oklahomans are well-served by this potential law.

Finally, though I urged Sen. Loveless, its House author, Rep. Kannady, and others in the Legislature to vote “No,” HB 1913 now comes to your desk for approval. It’s not surprising the bill passed by the margins it did in the House and Senate; the most positive note is that it drew bipartisan opposition. It’s difficult to see how this bill can possibly better the lives of Oklahomans, and I would respectfully urge its veto. Thank you for taking the time to consider my request.

– Janet E. New lives in Oklahoma City