BY DAVID PERRYMAN

A venture into Haskell Head’s Pharmacy in the early 1960s was an amazing experience. Not only did the small storefront have that feeling that it had been there since statehood, collecting and retaining all sorts of unique merchandise, it was a dimly lit cavern of curiosity. Items hung from the walls and ceiling and spilled off of tables and shelves into narrow aisles that at one time may have been organized.

A venture into Haskell Head’s Pharmacy in the early 1960s was an amazing experience. Not only did the small storefront have that feeling that it had been there since statehood, collecting and retaining all sorts of unique merchandise, it was a dimly lit cavern of curiosity. Items hung from the walls and ceiling and spilled off of tables and shelves into narrow aisles that at one time may have been organized.

Each item had a use, everything was for sale and Mr. Head was one of the kindest and most essential men that I had ever met. Doctors whose offices were often on the second floor of a bank building as well as their patients trusted him to serve up “just what the doctor ordered,” whether it be elixirs, syrups, compounded creams or some other concoction.

Aside from the area where pharmaceuticals were dispensed, the brightest area in the building was the soda fountain where cherry phosphates, crème sodas and strawberry shakes were on tap. The most frequent delicacy was a simple hand dipped ice cream cone served up after the obligatory question, “one dip or two?” was followed by “one, please.”

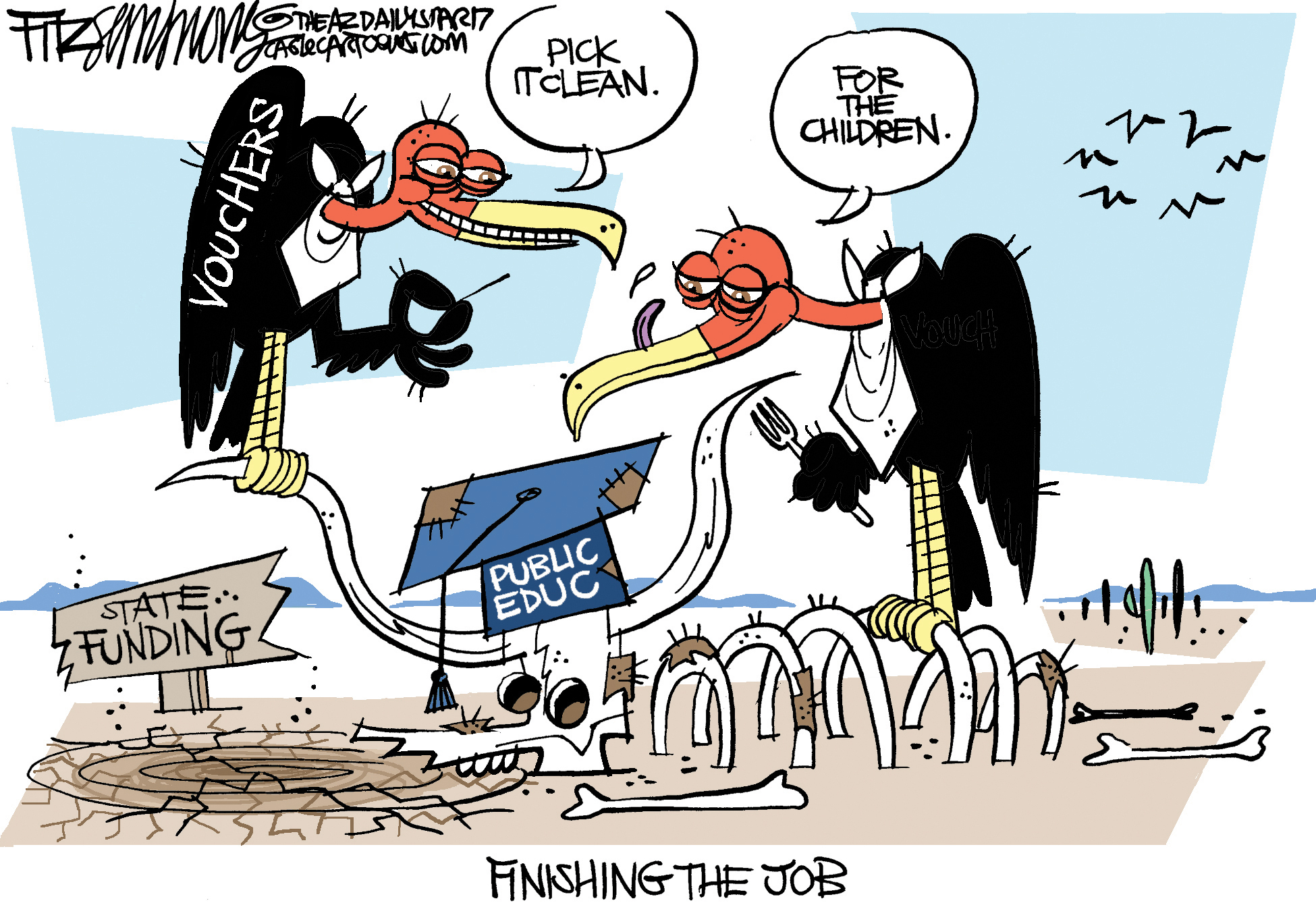

Today, in the arena of private school financing, no one stops at one dip.

For years, wealthy Oklahomans have sought to direct public education tax dollars toward their children’s private school tuition. For years, Oklahoma protected public education tax dollars for public schools. Over the past decade, however, private school patrons have funded campaigns and legislators who are willing to provide a path toward using tax dollars for private school tuition have been elected.

Thanks to a 2011 law called “Oklahoma Equal Opportunity Education Scholarships, launched in 2013, millions of tax dollars are being redirected to fund the private education of children of parents earning hundreds of thousands of dollars per year. In its inaugural year, 38 students participated. This past school year that number rose to 2,209 and the income cap has literally been removed.

The double-dipping comes in when an individual or corporation donates money to a non-profit Scholarship Granting Organization or SGO. Not only does the donation allow the donor to claim a charitable contribution, they also receive a tax credit of 50% of the amount of the donation. So while the charitable contribution reduces taxable income, the tax credit reduces the amount of income tax due dollar for dollar.

Oklahoma’s anti-public school Legislature has made additional tweaks to the law that further exacerbate the misdirection of education funding. The amount of tax credits that could be claimed increased in 2015. Assuming a taxpayer made a $200,000 donation to an SGO, they would receive a tax credit of $100,000 unless they promised to make the same donation for three consecutive years in which case they would receive a $150,000 tax credit for year one and $100,000 in each of years two and three.

Originally, parents could not earn more than $136,530 per year but legislators carved out an exception that disregarded the income eligibility requirements for students living in a public school district designated as “in need of improvement.” Consequently, private school families could financially benefit even when education funding cuts are the cause of a public school’s problems and private school scholarships undermine public education funding.

Perhaps the most egregious component of the plan harming public education is the provision that “once a student has received a scholarship, that student and his or her siblings remain eligible until high school graduation.” So regardless of the future performance of the public school or whether private school parents earn millions of dollars per year, public tax dollar financed scholarships will continue to be channeled into the pockets of private school families.

Mr. Head had no elixir for this problem. It can only be solved with an informed and engaged electorate.

– David Perryman, a Chickasha Democrat, represents District 56 in the Oklahoma House