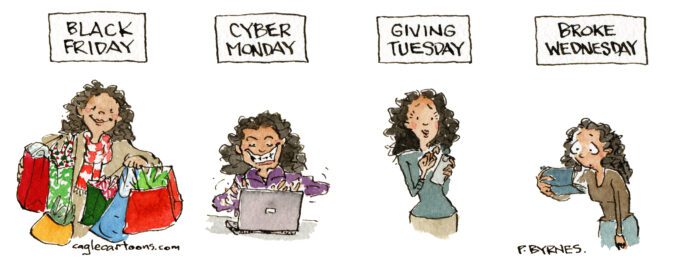

Well, two months of Black Friday sales finally came to an end Friday – followed by Small Business Saturday and yesterday’s Cyber Monday. Like late night audiences being told when to clap, American consumers have been programmed to spend, spend, spend. Advertisers and the media dependent upon them push the spending frenzy as if it is a patriotic duty.

Network morning shows – where squealing, stealing deals are a regular staple – hit hyper-hype as Black Friday approached, some even honest enough to denote segments had been paid for by advertisers.

Such advertorial material – disguising ads as news copy – was long the bane of my generation of journalists. We saw it as a taint on our integrity. It became part of the job description for subsequent ink-stained wretches. [The prevalence of tease/don’t tell reportage made the entire television news community suspect in our eyes – and still does.]

Even HuffPost, a legit news site that features stories of interest to progressives, had a sidebar on its homepage hawking eight different sales extravaganzas.

The end result of continued commercial campaigns is that cancerous consumerism is consuming Americans. The old “keeping up with the Joneses” mantra has made us a nation of debtors with bleak financial futures looming.

At the end of this year’s third quarter, the Federal Reserve reported: “Household Debt Ticks Up to $17.94 Trillion; Delinquency Rates Remain Elevated.

“Total household debt increased by $147 billion to reach $17.94 trillion, according to the latest Quarterly Report on Household Debt and Credit. Aggregate delinquency rates edged up from the previous quarter, with 3.5% of outstanding debt in some stage of delinquency.”

The bulk of that debt consists in mortgage balances, $12.59 trillion. Those should be anticipated, designated payments which help establish the monthly budget.

But “Credit card balances, which now total $1.17 trillion outstanding, grew by $24 billion during the third quarter and are 8.1% above the level a year ago,” according to the Federal Reserve. These are fluctuating, controllable expenditures. Unfortunately, many people now use their credit cards as if loan offices, where Bankrate reported last week that the average credit card interest rate is 20.42%.

And a CBS report Monday indicated that 28% of Americans still owe on last Christmas’s purchases.

Along with predicting 60 years ago the environmental greedhead degradation of his beloved Florida – and the rest of the world – author John D. MacDonald decried the loss of thrift that threatened Americans’ security. Maybe it was that children of the depression were suddenly flummoxed at being flush, but Travis McGee’s economist pal [No-First-Name] Meyer nailed the attitude of the day – and its consequences for Florida retirees.

Referring to a [fictional] survey in 1973’s The Scarlet Ruse, Meyer observes:

“ … [T]he essence of it is that all too many of them were screwed by consumer advertising: Spend, spend, spend. Live for today. So they lived out their lives up to their glottis in time payments. They blew through it all on boats and trailers and outboard motors, binoculars and hunting rifles and department store high fashion. They lived life to the hilt, like the ads suggest. Not to the hilt of pleasure, but to the hilt of spending. They had bureau drawers full of movie cameras, closets full of records players and slide projects. Buy the wall-to-wall carpeting. Buy the great big screen. Visit all the national parks in America. Funny thing … Now their anger is directed outward, at society, because they don’t dare look back and think of how pathetically vulnerable they were, how many thousands they blew on toys that broke before they were paid for, and how many thousands on interest charges to buy those toys. They did what everybody else was doing.”

The toys have changed through the years, but spending beyond our means or future needs remains an American illness.

National debts can be employed to build things and stimulate the economy. Individual [and state] debts only build trouble and stimulate anxiety. Have a sensible holiday spending season.