BY EDWIN E. VINEYARD

Republican office holders and candidates have taken at least one too many oaths. National office holders have an oath to protect and defend the Constitution of the United States. Presumably that includes supporting the rights stated therein and the purposes as stated in the Preamble, i.e. promote the general welfare, establish a more perfect union, etc. Presumably it also includes making laws and rules objectively, for the good of all, and with integrity – free of the corruption of money or influence.

This one oath is enough. Any other oaths and pledges only tend to corrupt this one.

In government there can be no more sacred an oath. The oath to uphold the Constitution of the United States is above all secular pledges. There must be no conflicting oaths or pledges about how one is going to carry out the duties of a congressperson a president, or a judge. To take such oaths or to make such pledges to serve a particular ideology or set of political beliefs is an effrontery to this nation and a violation of the oath of office.

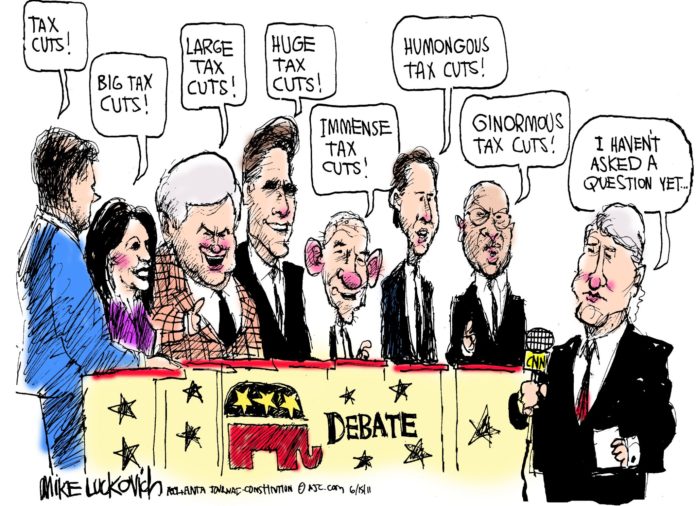

All those republican office holders who have signed the NO TAX OATH with Grover Norquist’s Americans for Tax Reform are in serious conflict with their official oath of office. One cannot serve two masters. They cannot serve the interests of Norquist’s league of billionaire campaign donors, and at the same time promote the general welfare of the people of the United States.

We hope that we are not mistaken in seeing signs that our own U.S. Sen. Tom Coburn is waking up to the reality of that conflict of interest, while at the same time his party leaders like Rep. Eric Cantor and House Speaker John Beohner are breaking off negotiations on deficit problems as the focus shifted from cutting expenditures to increasing income. Reasonable persons know and accept that this deficit problem cannot be solved without approaching it from both raising revenues and cutting expenses.

Sen. Coburn now admits that we have to look at increasing income by getting rid corporate tax breaks – not only those for ethanol interests but those for oil companies and lots of others. He is right. Analysts use a term to describe these tax giveaways to special interests. They call them “tax expenditures” – that is, spending the taxes by never collecting the money. Coburn calls them “earmarks.”

Some have said that these give-away tax breaks amount to several trillion dollars over 10 years.

Coburn is one Republican who seems to recognize the immorality of the “Buffet and his secretary” tax pattern that is common across the country. He says correctly, “There is something wrong about that.” But just how far the senator is willing to go in making the tax code fairer to lower level payers is yet to be seen. Most will recall that muli-billionaire Warren Buffet pointed out the irony that he pays a lower rate on his income than does the secretary in his office on hers.

Some have suggested “turning the tax tables upside down.” That thought is not based upon the fact that base rates lack much of progressive upward, but rather on the much lower rates paid for non-earned income such as capital gains which is the major income domain of the wealthy. That is “making money on wealth.” Due to Republican resistance last year to change in the tax codes to eliminate a tax-free loophole, the gains of Warren Buffet and other billionaires in the Berkshire Hathaway financial fund still remains untaxed today.

And such is the case for all the other “hedge funds” and capital funds in which billions of the investments of billions of our most wealthy remain tax-free. How can this possibly be fair in a system that taxes money people earn in wages? It is unfortunate that many of these same funds are known to buy up businesses, take them out of the tax market, reduce jobs, export jobs abroad, and engage in other business behaviors not in the best interest of the economy or the nation. Why should such income go untaxed? Why reward such practices?

If we correct all this, and if we get rid of the Bush Tax Cuts, it might not be necessary to be looking at serious cuts in vital expenditures, certainly not viciously attacking Medicare and Social Security. No doubt there would, and there should be, cost savings cuts throughout the government. Some are quick to suggest that our military is our greatest discretionary cost, and that we should be looking at more efficiency there as well as a reduction of our commitments around the world.

Let us see if Mr. Coburn is merely a chink broken loose from the party dam, if he stays with his new positions, and if any of his tribe follow his path.

– Dr. Edwin E. Vineyard, AKA The Militant Moderate, lives in Enid, OK and is a regular contributor to The Oklahoma Observer

Thank you for pointing out the inherent conflict involved among the current crop of extreme conservative Republicans allegedly representing “the people”, as regards their oath not to raise taxes and their official oath of office to uphold and defend the Constitution of the United States.

In my view, they (and all officials/politicians) should be required to denounce all other political oathes prior to taking an oath of office.

Most federal employees are subjected to heavy security clearances prior to being offered any position of responsibility in government. The least that we as citizens, voters, and taxpayers, that we should be able to expect, should be that elected officials must clear the same hurdles, to ensure that there is no conflict between their backgrounds and their pledges to support and defend the Constitution of the U.S., and represent ALL of the citizens of their districts.