BY VERN TURNER

Paul Buchheit recently wrote a scathing piece citing why the great lie about deregulation is destroying our economy. Below is my summary of his points and citations that make his point one of the more chilling realizations for those of us who actually want our nation to succeed for a while longer.

Paul Buchheit recently wrote a scathing piece citing why the great lie about deregulation is destroying our economy. Below is my summary of his points and citations that make his point one of the more chilling realizations for those of us who actually want our nation to succeed for a while longer.

1. The taxes avoided by one “business”-man would have covered the salary of 30,000 nurses.

The lack of regulation in the financial industry allowed hedge fund manager John Paulson to conspire with Goldman Sachs in a plan to create packages of risky subprime mortgages … then short-sell [bet against] the sure-to-fail financial instruments. The ploy paid him $3.7 billion. Deregulation in the tax code allowed him to call his income “carried interest,” which is taxed at a 15% rate. More deregulation allowed him to defer his profits indefinitely.

The lost taxes of $1.3 billion [35% of $3.7 billion would cover the salaries of 30,000 LPNs. Instead, one clever businessman took it all.

2. The 10 richest Americans made enough money to feed virtually every hungry person on Earth for a year, or maybe just half that number for two years.

The richest 10 Americans increased their wealth by over $50 billion in one year. That’s enough, according to estimates [2008] by the Food and Agriculture Organization and the UN’s World Food Program, to feed the 870 million [starving] people in the world.

But should anyone be blamed for this imbalance? Didn’t the rich people EARN their money through hard work and innovation? Sixty percent of the income for the Forbes 400 came from capital gains. A lot more of it came from other forms of deregulatory subterfuge like carried interest, performance-related pay, stock options, and deferred compensation.

3. Taxes not paid via loopholes would pay-off the deficit or 20 million jobs. Take your pick.

The backlash against government regulation has led to tax abuses that cost us almost $1 trillion a year.

Corporations doubled their profits to $1.9 trillion in less than 10 years, but since 2008 they’ve reduced their tax payments from a 20-year average of 22% to just 10%. That’s a drop-off of over $225 billion.

The Tax Justice Network estimated that up to $32 trillion is hidden offshore, untaxed. With Americans making up 40% of the world’s Ultra High Net Worth Individuals and with a historical stock market return of 6%, $750 billion of income is lost to the U.S. every year, resulting in a tax loss of about $260 billion.

Finally, the IRS estimates that 17% of taxes owed were not paid, leaving an underpayment of $450 billion.

The deficit could be covered but because of lax or non-existing regulations that allow wealthy individuals and corporations to avoid their tax responsibilities.

4. Unregulated trading industries prevent another $350 billion per year in tax revenues.

For a $10 purchase of children’s clothing, mothers pay up to a dollar in sales tax.

For a $10 purchase of financial instruments, investors refuse to pay one cent.

We had a financial transaction tax from 1914 to 1966, but it was repealed in a surge of Congressional deregulation. Now, it is estimated that $350 billion could be generated every year, enough for almost 10 million teachers or nurses or firefighters or medical technicians.

5. Wealth distribution to the top few percent is destroying entrepreneurship in the United States.

Because of financial deregulation, our country’s income and wealth keep moving to the top while the middle class shrinks. Entrepreneurship is going down with it.

Studies reveal that relatively few business startups are initiated by the very wealthy. Only 3% of the CEOs, upper management, and financial professionals were entrepreneurs in 2005, even though they made up about 60% of the richest .1% of Americans. Instead, they invest over 90% of their assets in a combination of low-risk investments [bonds and cash], the stock market, and real estate.

Entrepreneurs come from risk-takers in the middle class, but with financial deregulation causing redistribution toward the top, the money has been taken out of the hands of middle-class innovators resulting in a 53% decrease in entrepreneurs since 1977.

Recently, venture capitalists invested in a variety of ideas that could pay off big. The entrepreneur spirit created risk takers. Often, a venture capitalist only “hit” on 25% of his/her attempts, but when they hit the losses from the “misses” were easily absorbed. That kind of support for progress and innovation is what made us a great nation, not fiddling regulations to benefit the few.

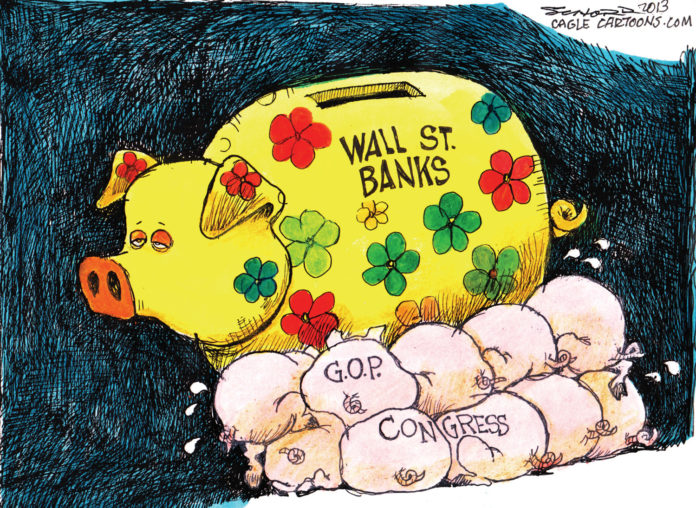

Without the hyperbole these data scream for, it must be clear to everyone what is meant by “deregulation” in the world of finance. The lies coming from the Republicans about tax cuts creating jobs and deregulation creating jobs are not getting sufficient attention. Why not? PEOPLE! They are stealing your money and your country.

Try finding venture capital today. You’ll have to visit the Cayman Islands or Switzerland, because that’s where the money went.

Without operating revenue, our services decline in quality and quantity. That’s why Republicans insist on destroying the New Deal programs that actually assist citizens in need. They want the money for themselves and their patrons on Wall St. and in corporate board rooms …. at least the ones where they are not yet sitting in. This is what Marx meant when he said that unregulated capitalism will destroy itself from within.

Welcome to “within.” Sen. Elizabeth Warren eloquently states: “The system is rigged!” Yes, it is. The “riggers” intend this so they would become ever richer and, presumably, more powerful. Why? What has power to do while a nation collapses?

In Rebecca Costa’s book, The Watchman’s Rattle, she suggests that our primitive instincts remain even as our societies become increasingly “sophisticated” and complex. The question remains: Why do we do these things that defy our best interests?

Why do we ignore the point that regulations are necessary? Somewhere along the way the regulations were necessary. Well, using the theorem of simplicity, regulations became necessary because somebody was trying to screw somebody else unfairly to create an unfair advantage, a monopoly or a suffocation of fair market trading. Imagine that. Why would anyone do that?

Well, it’s because that’s who and what we are as an organism, a species. It’s what got us to be successful in terms of tribal survival against hunger, thirst, other tribes and predation.

The regulations are in place to ensure our survival within the system we’ve chosen. Not all of them are perfect, but most of them are necessary. Ask the magic 400 about that. Then ask the guy living out of dumpsters in some inner-city slum and you’ll have your answer.

Clearly, more deregulation means less money for goods and services for those who need them, the so-called masses. So, how do the magic 400 expect to keep getting richer if they are cutting off the sources of their own revenue stream by their lust and rush for unseemly wealth? Do they think they can get away with this forever? Maybe. I just don’t think they care.

– Vern Turner is a regular contributor to The Oklahoma Observer. He lives in Marble Falls, TX, where he writes a regular column for the River Cities Daily Tribune. He is the author of three books – A Worm in the Apple: The Inside Story of Public Schools, The Voters Guide to National Salvation and Killing the Dream: America’s Flirtation With Third World Status – all available through Amazon.com.

I agree with most of what you’ve written here. Good piece with lots of good stats.

I’m a little concerned by the ways our government seems to be finding to run around the tea party and their ridiculous shenanigans. If they won’t let us impose real and helpful taxes, it seems like the government is finding ways to impose fees and taxes elsewhere that are out of the public eye. For instance, I know the OK Corporations Commission is considering a new levy on phone usage to give more money to rural phone providers. The ends don’t make a lot of sense to me in this day and age, but the means are what are scary. Shouldn’t an elected body have to at least have a public hearing?

And there are a million examples like this. That’s the scary part!

Can you say something to alleviate my fears?