BY SHARON MARTIN

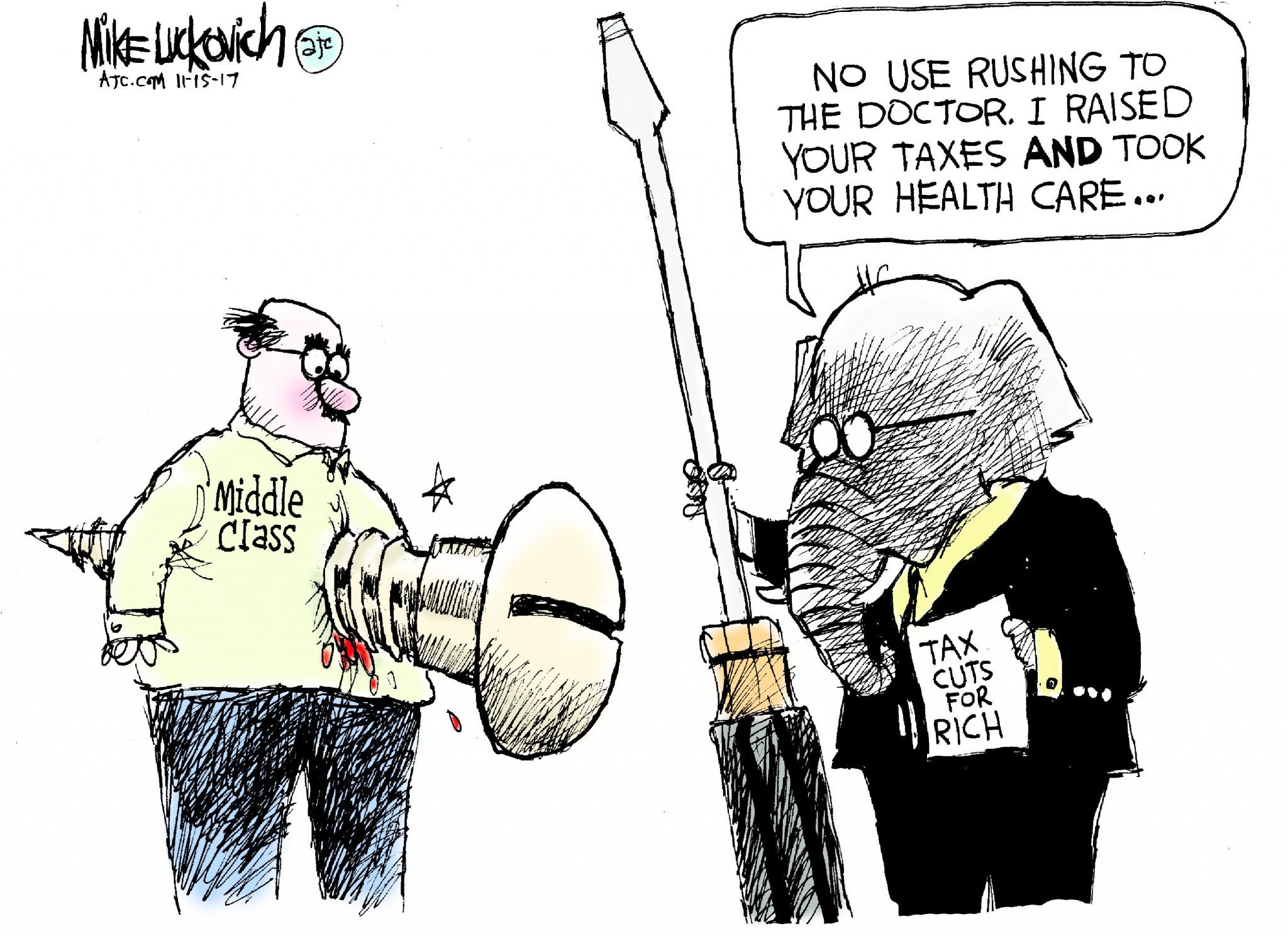

Supply-side economics works for no one but the already wealthy, but the hucksters are at it again. Giving breaks to rich donors is not good for most of us, but don’t just take my word for it.

Supply-side economics works for no one but the already wealthy, but the hucksters are at it again. Giving breaks to rich donors is not good for most of us, but don’t just take my word for it.

A recent Credit Suisse study shows that millennials [those born between 1982 and 2000] are “unlikely to earn more than their parents despite being more highly trained.”

It’s harder for millennials to borrow money. Home prices continue to rise. Except in finance or technology, incomes haven’t.

College is ever more unaffordable, and college debt is unforgiveable even if one files for bankruptcy. To make it harder, the GOP’s so-called tax reform will tax tuition wavers as income, making it virtually impossible for anyone other than the fabulously rich to be able to afford graduate school.

Income inequality is wider now than it has been since the 1920s. A chart by the nonpartisan Center on Budget and Policy Priorities, using data based on census and IRS records, shows a steady rise in income at all socio-economic levels between the end of World War II and the 1970s.

Then Reagan happens. Cutting taxes and breaking unions stopped income gains except for those at the very top. Only the very wealthy have continued to make progress for the past four or five decades.

Any small gains when a Democrat gets into office are quickly erased when the GOP takes control of the House and Senate.

Republican lawmakers consistently undermine any attempts to raise minimum wage, despite the fact that those places that have raised wages have seen positive results.

The GOP refuses to acknowledge the need for universal healthcare. They trash public education in favor of for-profit schemes. They won’t admit that educated citizens not only earn more but also broaden the tax base.

Cutting taxes on corporations does not put money into workers’ pockets.

Eliminating the estate tax will widen the gap further and create a wealth-based nobility.

Right now, estate taxes are not levied on the first $5.49 million. That’s $5 million-plus exempt! And in 45 states, including Oklahoma, there is no inheritance tax. I know you’ve heard horror stories, but you get to keep your tractor, dude.

It is not estate taxes but debt that costs most families their farms or small businesses during economic downturns.

Who will benefit if the GOP tax bill passes? The president. And a few of his donors! The bills making their way through both houses will do to the country what GOP economics has done to Oklahoma.

When will lawmakers tell the truth?

When will poor and middle class voters finally say, “Enough!”

– Sharon Martin lives in Oilton, OK and is a regular contributor to The Oklahoma Observer. Her children’s book, Froggy Bottom Blues, can be purchased in hardcover or paperback from Doodle and Peck Publishing. It also is available in paperback from Amazon.