Editor’s Note: This is the second of two essays by veteran Oklahoma educators analyzing State Question 779, the proposed one percent sales tax increase for public education that will appear on the Nov. 8 statewide ballot. Both essays first appeared in the September edition of The Oklahoma Observer.

BY SHARON MARTIN

My daughter was shopping for the things on her son’s pre-kindergarten school list last year. She made two trips into Tulsa for the right kind of mat and visited several stores for the correct brands of school supplies, wipes, and tissues.

My daughter was shopping for the things on her son’s pre-kindergarten school list last year. She made two trips into Tulsa for the right kind of mat and visited several stores for the correct brands of school supplies, wipes, and tissues.

“How do one-income parents afford this?” she asked.

They can’t.

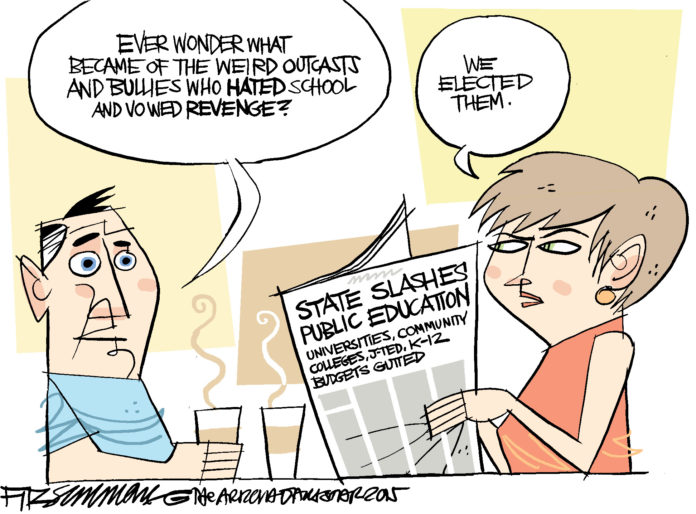

There has been a steady dismantling of the contract between citizens and the state over the past several years regarding public education. Give private companies a chunk of money here and a gob of money there, and soon there is no money left to pay for basic services or supplies. Cut the requirements of a librarian here, class size there, and soon there are no standards.

Siphon off funds for charters, testing, and teacher evaluations. Mandate changes that have nothing to do with student progress or wellbeing. Cut funding. Cut taxes, so you have to cut funding again. Lay off personnel. Shorten the school year. Ask already strapped parents to buy copy paper. Ask teachers and administrators to spend part of every Friday hawking treats so the school can afford field trips at the end of the year.

It seems that someone wants public education to fail, but teachers keep holding up the walls.

Teachers in my school found a deal that lets them individually sign up for ink cartridges for a fixed monthly rate. Do secretaries bring their own ink cartridges? Do legislators?

Our legislators budgeted a 183% raise, $9 million, for the Legislative Service Bureau. They take care of themselves. And they take care of their donors.

Some oil industry tax loopholes have been set up to expire in three years. All a company has to do is reorganize every three years. Who cares if their employees’ children have ancient textbooks, if there are 25 kindergarteners with one certified teacher?

Do schools need the income that another penny sales tax would provide? Yes. But can the already strapped parents afford to pay another penny on every dollar of groceries they buy? No.

We’ve asked enough of parents, teachers, and administrators. It’s time to ask the oil industry to support the schools that educate their employees’ children. It’s time to ask those with high incomes to pay their fair share so that the next generation has the opportunities to succeed that they did.

It will be an uphill battle to reverse recent tax cuts. Legislators would rather short the citizens than anger their donors. It will be a battle with Goliath to cut loopholes and giveaways. But the future, the wellbeing of our children and theirs, is at stake.

– Sharon Martin, a longtime public schools reading specialist, lives near Oilton and is a regular contributor to The Oklahoma Observer