BY DAVID PERRYMAN

Jenga is a game played with 54 wooden rectangular blocks. Each block is three times as long as its width and one fifth as thick as its length. After the blocks are tightly stacked 18 levels high, players take turns removing blocks from the stack and balancing them on top of the tower, creating a progressively taller but less stable structure.

Jenga is a game played with 54 wooden rectangular blocks. Each block is three times as long as its width and one fifth as thick as its length. After the blocks are tightly stacked 18 levels high, players take turns removing blocks from the stack and balancing them on top of the tower, creating a progressively taller but less stable structure.

Over the past decade, special interests and their lobbyists guiding the Oklahoma Legislature have used Jenga rules to establish tax policy and appropriate funds. During this period, Oklahoma has become progressively less stable.

Public Education is a favorite whipping boy of the elite and wanna-be elite. Even before the current world oil glut and price correction, our K-12 budget cuts were the deepest in the country.

As a reminder, during the period of prosperity when oil was $115 per barrel in June 2014; $119 in March 2013; $125 in March 2012 and $127 in March 2011, the Legislature cut Oklahoma’s per pupil inflation-adjusted K-12 expenditures.

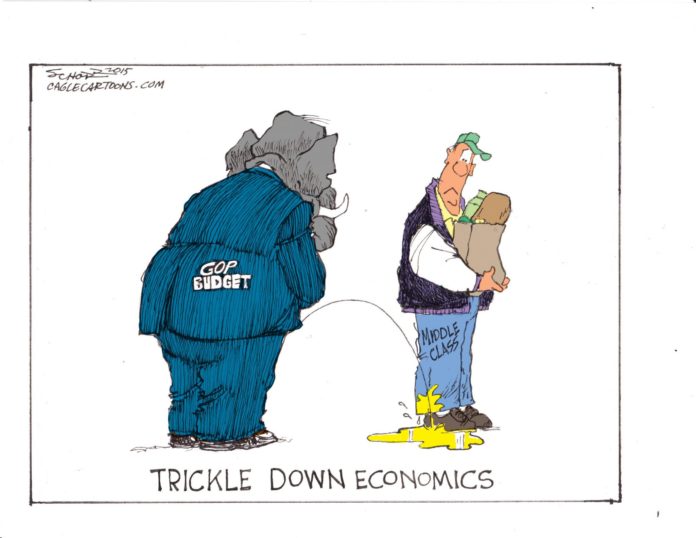

From FY08 through FY15, the anti-public school legislature cut K-12 education by 23.6% and redirected nearly one in four education dollars to tax cuts for the wealthy and tax credits for corporations.

The new budget approved last Friday cuts Oklahoma’s entire $33 million textbook fund for local schools and another $40 million from essentials like alternative education and remedial student services. Despite these cuts, anti-public school legislators and their corporate “sponsors” unceasingly pursue corporate charter schools, vouchers and ESA’s to skim public funds for private and religious schools.

Education cuts did not end at K-12. Some speculate that this year’s 15.9% Higher Education budget cut is retaliatory because the Legislature was angered when OU’s President David Boren proposed a ballot initiative to increase funding for K-12 and higher education. In any event, the FY17 higher education budget is $67 million less than FY16 and an additional $112 million less than FY15.

Of course, if education budgets were not slashed, corporate interests could not continue to enjoy their tax shelters and credits.

Perhaps the most offensive example of legislative hypocrisy occurred when it repealed the refundable share of the Earned Income Credit [EIC]. The EIC provided the poorest 200,000 working taxpayers with an average of $147 per year. Legislators seeking repeal of the EIC could not comprehend how a cash tax credit could possibly be fair.

Poor working Oklahomans had no wining-and-dining lobbyists to remind legislators that hundreds of millions of dollars in tax credits are being handed out annually to corporations and many of those corporate tax credits are transferable.

What often happens is a company, receiving a transferable tax credit that is worth more than the company owes in taxes, can use the portion they need and then sell the remaining tax credit for 75% to 80% of its value to another corporation to decrease what they owe the state. This is a win-win situation for both companies but the state of Oklahoma and its citizens receive zero dollars.

Since working Oklahomans have no lobbyists to point out this hypocrisy, the refundable Earned Income Credit is no more and the transferable corporate tax credit lives to see another day.

Every game of Jenga ends when the blocks crash down. Unless you demand accountability from your elected state officials, Oklahoma will face the same result.

– David Perryman, a Chickasha Democrat, represents District 56 in the Oklahoma House