BY JOE DORMAN

At the time of writing this column, our state elected officials are still at an impasse regarding a budget agreement and a resolution to the ongoing Special Session called by Gov. Mary Fallin. OICA has been active in calling for Republicans and Democrats to work together to address the $215 million budget hole created after the courts struck down an unconstitutional cigarette fee.

At the time of writing this column, our state elected officials are still at an impasse regarding a budget agreement and a resolution to the ongoing Special Session called by Gov. Mary Fallin. OICA has been active in calling for Republicans and Democrats to work together to address the $215 million budget hole created after the courts struck down an unconstitutional cigarette fee.

The $215 million reduction – which balloons to over $500 million when federal matching funds are included – will either be spread across state government or, if no legislative action is taken, be shouldered exclusively by three agencies that oversee health care and social service programs.

Neither scenario should be acceptable to voters or to our lawmakers.

Several options for closing the budget hole have been discussed, including a [constitutional] $1.50 per pack cigarette tax hike, an increase in income taxes for high earners, and an increase in the gasoline tax. Other ideas presented have dealt with taxing “luxury” services, like tattooing and lawn care.

The increase in the gross production tax has been something discussed by the public, but has gained little traction inside the Capitol among the Republican supermajority.

Meanwhile, OICA has called upon our elected officials to reinstate at least a portion of the Earned Income Tax Credit which assists families struggling to make ends meet as a form of tax relief.

While informal and behind-the-scenes negotiations continue, the rank-and-file membership of the Legislature has been sent back home at the call of the presiding officer. Essentially, the leaders of the House and Senate called a “timeout” rather than spend roughly $30,000 per day to keep the rest of the Legislature at the Capitol.

Unfortunately, a compromise does not look imminent. While there are some other ideas that have been thrown out for resolving budget issues going forward, nothing has been advanced or publicly endorsed by both parties. OICA will keep you apprised of updates through our social media pages, including our website, Facebook and Twitter.

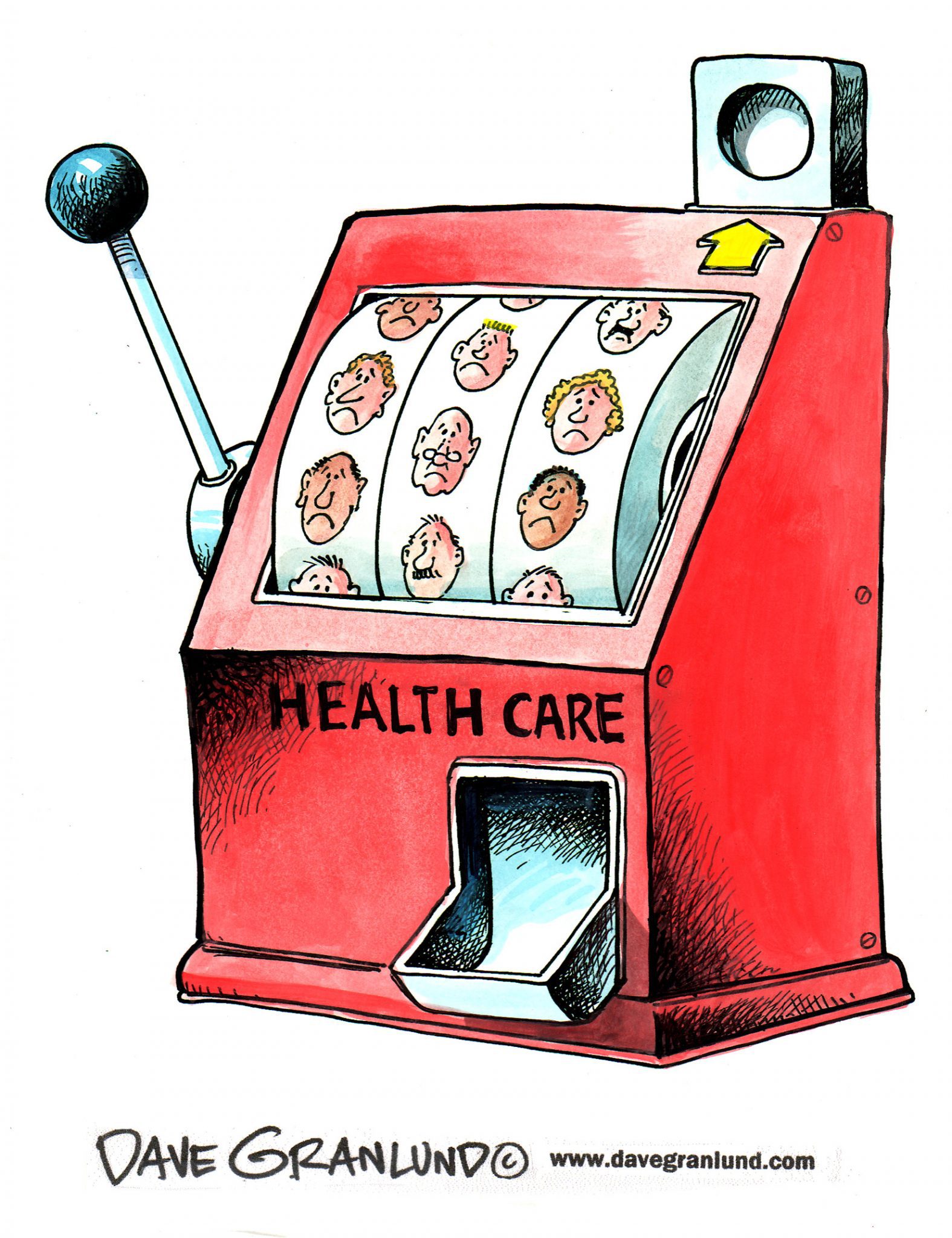

Sadly, funding issues that directly and negatively impact Oklahoma health care are not limited to the state Capitol. The failure of the federal government to reinstate the Children’s Health Insurance Program, or CHIP, threatens to cut off health insurance for sick kids.

The program, created under a 1997 law and passed with bipartisan support at the time, provided coverage for children in families with low and moderate incomes as well as to pregnant women. It was instrumental in lowering the percentage of children who were uninsured, reported at nearly 14% when it started. Current numbers through KIDS COUNT Data list the uninsured rate for children at 7% for Oklahoma and 5% nationally for 2015, the last year of collected data.

CHIP was last reauthorized in 2015 and was due to be renewed by Sept. 30, 2017. This expired over the weekend, but efforts are being made to encourage Congress to act quickly before states run out of funding.

Oklahoma has seen success with CHIP, utilizing $49 million annually to assist in covering 122,000 Oklahoma children. Should our federal elected officials not act, that financial burden will fall on the state at the worst possible time.

Please use your voice as a child advocate and contact your senators and representatives and ask them to act soon to address budget issues that will impact the children of our state and nation. – Former state Rep. Joe Dorman is chief executive officer of the Oklahoma Institute for Child Advocacy