BY JOHNSON BRIDGWATER

Are you aware that not just oil and gas, but also Oklahoma coal is costing the state of Oklahoma millions of dollars in tax subsidies annually?

Oklahoma coal, considered some of the nation’s poorest quality due to its high sulfur content, brings with it two entirely separate tax subsidies – one for the companies involved in its excavation, a second for the companies actually burning the coal right here within our borders.

The worst part is these tax incentives are transferrable, and each year companies like AES Shady Point are actually profiting on Oklahoma tax breaks by selling their tax incentives to other companies.

In 1989, Oklahoma mining companies persuaded the state Legislature to pass a $5-per-ton, freely-transferable tax credit. Then in the mid-2000s, it passed a second coal tax credit – a $5 per ton, freely-transferable tax credit specifically for AES Shady Point for the burning of Oklahoma-mined coal for electricity generation.

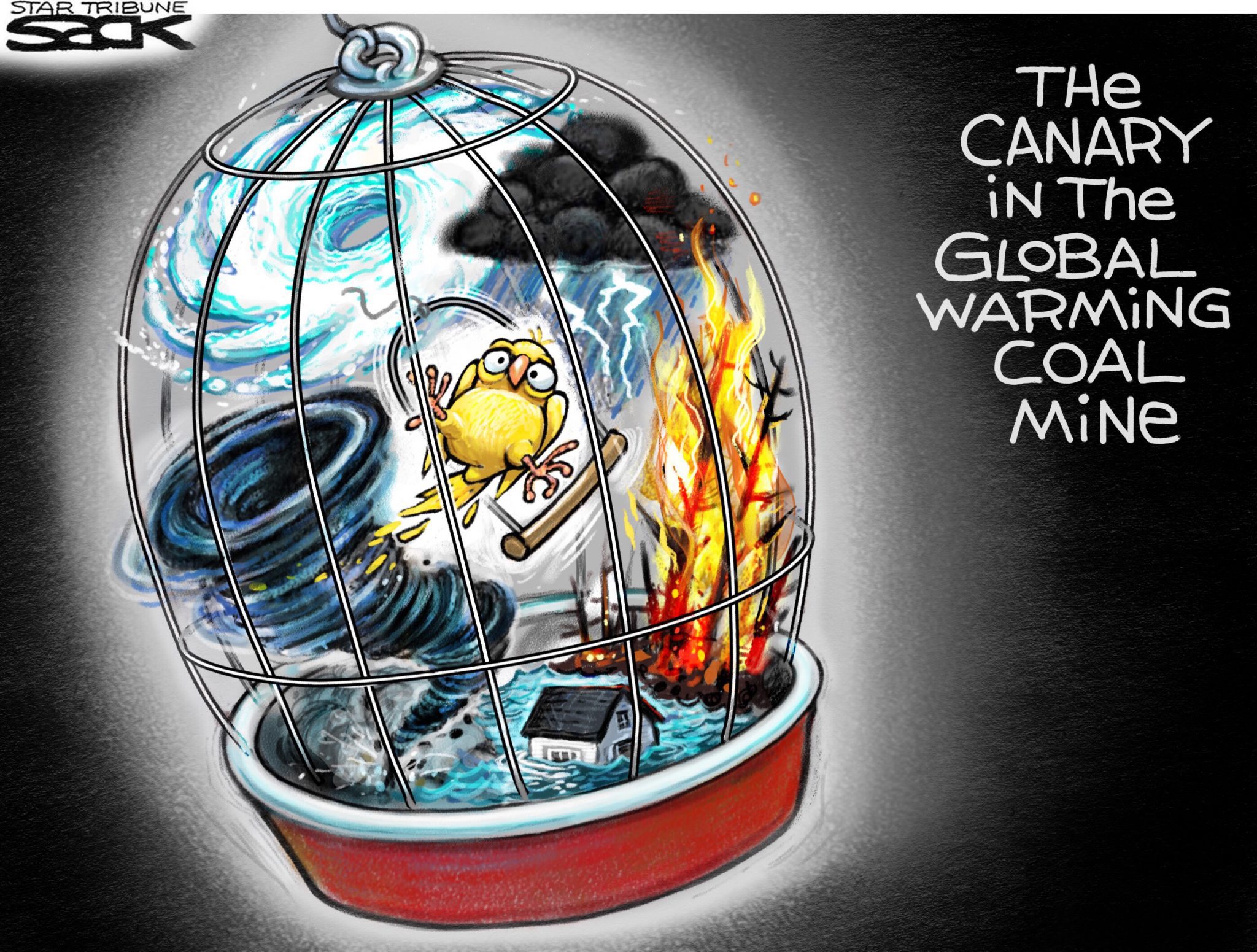

So consider this second credit – it is literally paying a company to burn Oklahoma coal within our borders, even though burning coal is considered the single most harmful environmental act. It not only worsens climate change, but also contaminates lakes with mercury – levels are so high in 54 Oklahoma lakes that it is not considered safe to eat fish caught in them.

Why would Oklahoma lawmakers not only establish such a tax credit, but now refuse to abandon it in the face of mountains of scientific data proving its harm?

Most amazing, the firm hired by the state to evaluate tax subsidies recommended the state eliminate coal tax subsidies – see the State of Oklahoma Incentive Evaluation Commission’s Sept. 27 report. Yet, the state has made no such moves to do so.

What is most frustrating is that Oklahoma coal production peaked at 5.73 million tons in 1981, and decreased every year since, down to 796,859 tons in 2015.

Indeed, the coal subsidies discussed here were established because Oklahoma coal industry was failing. Without these subsidies there is no question the industry would shutter itself in short order.

However, rather than do the right thing and kill these tax giveaways, a large and vocal group of legislators is instead turning to Oklahoma wind as a means to fill Oklahoma’s coffers. But herein lays a massive problem: creating a “gross production tax” on wind makes no sense, because wind is limitless and it does absolutely no harm to the Oklahoma environment. Gross production taxes are levied on items that are finite and cause environmental harm to the state.

It is now more than clear that the state is in a financial crisis. From failings at the state Department of Health to the repeated unmet needs at the state Department of Education to the fact that all of the major agencies at the state level involved in the oversight and management of Oklahoma’s environmental landscape have had their budgets slashed annually for several years now, Oklahoma needs a massive budgetary fix – and it needs it immediately.

Unfortunately, the direction our state elected officials are leaning points towards ignoring the obvious, and instead pursuing ideas that have not gained any footing elsewhere.

Coal giant Wyoming is the only state that taxes wind generation – and it has been shown their wind tax is a favor to their giant coal operations to keep the lid on wind energy, which is now the most economically competitive form of electricity generation most days of the year.

Sadly for Oklahomans, the Windfall Coalition – which is nothing more than a front-group for pro-oil [and massive oil mineral owner] Frank Robson and billionaire shale fracker Harold Hamm – have been spreading false information about wind energy, and paying for billboards to do the same, for the past four years.

All of this discussion leads to one final serious concern: the continuation of these tax subsidies, coupled with a pro-fossil fuel federal government, are leading to a new effort to expand Oklahoma’s coal industry.

The Bureau of Land Management is currently processing a rush request to grant the opening of a new mine in Oklahoma. The Pollyanna No. 8 has received a record-fast permitting process that will not even include public input nor public meetings.

Beyond Coal of Oklahoma did submit comments at the scoping phase of the BLM’s Environmental Review Process as required by the National Environmental Policy Act [NEPA], basically pleading with BLM to seriously consider clean air, climate, species, seismic effects, and impact on justice communities during its decision process. We discouraged them from approving this mine lease extension.

However, the BLM notified Beyond Coal that it had concluded its analysis, and has proposed moving forward with the mine lease extension.

This most recent act taken in Oklahoma suggests coal tax subsidies will continue to prop up an industry that is no longer needed, beneficial or economically viable. Coal mining expansion will simply lead to more pollution, more coal ash waste and fewer dollars to solve Oklahoma’s true budget needs.

– Johnson Bridgwater is director of the Oklahoma Chapter of the Sierra Club. This essay first appeared in the February print edition of The Oklahoma Observer.