BY DAVID PERRYMAN

The Oklahoma legislative special session just concluded its second week. While negotiations continued, there were no committee meetings to consider bills and no floor session. For a few hours in the middle of the week, it did appear that there was a glimmer of hope for a budget deal. The governor’s office communicated tentative approval of an agreement between her office and Senate Republicans and House and Senate Democrats.

The Oklahoma legislative special session just concluded its second week. While negotiations continued, there were no committee meetings to consider bills and no floor session. For a few hours in the middle of the week, it did appear that there was a glimmer of hope for a budget deal. The governor’s office communicated tentative approval of an agreement between her office and Senate Republicans and House and Senate Democrats.

The substance of the deal was that some of the gross production tax cuts and state income tax cuts that have been made over the past eight to 10 years would be reversed. GPT would be restored to 5% on new oil and gas wells and high income earners would see two new income tax brackets created: one for earners of more than $250,000/$500,000 and one for earners of more than $500,000/$1 million.

The two new brackets would affect just 26,071 taxpayers [1.48% of all Oklahoma taxpayers] and would cause the income tax bill of those who earn between $200,000 and $499,999 to go increase by an average of $6 per year while those who earn between $500,000 and $1 million would see an average increase of $189 per year. Those who earn more than $1 million would pay an average increase of $1,843 per year.

While all parties agreed that those changes would affect higher income taxpayers, it seemed to be the fair thing to do since it would partially reverse some of the tax cuts that have been more beneficial to wealthier taxpayers over the past decade. Legislators who were hesitant to reverse the GPT and income tax cuts were promised an increase in cigarette taxes and a reduction of the cigarette discount and a six cent per gallon fuel tax increase as well as a removal of the sales tax exemption on things like long term car rental, air craft rental, fur storage and landscaping and yard care services. The terms of the deal as summarized in a power point produced by the governor’s office also eliminated the sales tax exemption on wind turbine parts purchased for use in their construction.

The plan was structured to provide teachers with a $2,000 per year salary increase and to substantially fill what was expected to be a $400 million to $500 million budget hole next spring.

It was a classic “nobody likes everything but everybody likes something” compromise.

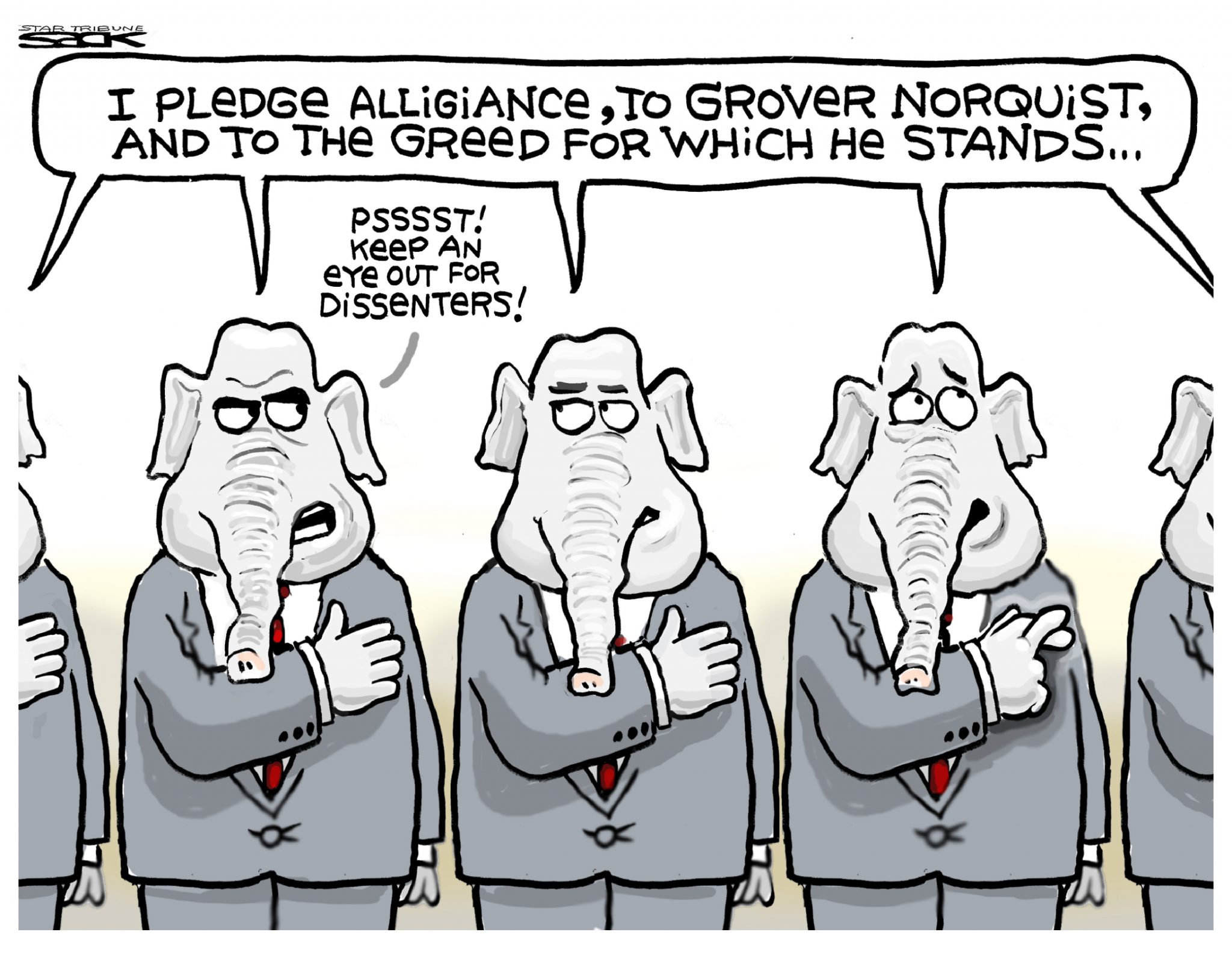

Unfortunately, the glimmer of hope was abruptly extinguished on Thursday afternoon when the power of lobbyists and legislative liaisons of three groups became too strong for conservative legislators. Those groups were 1] the oil and gas industry; 2] Grover Norquist’s Americans for Tax Reform who are holding “no tax increase” pledges signed by 23 legislators and Gov. Fallin; and 3] the Oklahoma Council of Public Affairs which believes with all their being that Oklahoma does not have a revenue problem.

Negotiations are ongoing and I will continue to keep you informed as we try to meet the needs of the state of Oklahoma and its people.

Two pending bills that have not yet been heard in committee are bothersome. HB 1065 by Rep. Jon Echols, R-OKC, and SB 9 by Sen. Stephanie Bice, R-Edmond, are both aimed at rural school annexation and administrative consolidation. Both of these legislators are from urban areas and continue to labor under the mistaken assumption that smaller schools need to be consolidated.

They are not in tune with the reality that rural schools have long been consolidated and are the model of economic efficiency and the shining success story in Oklahoma’s public education system.

The truth is that rural administrators rarely function solely as administrators because of their classroom and/or support personnel duties. According to the Oklahoma Education Coalition, a consortium of nearly a dozen education organizations, the administrator to student ratio for Oklahoma is the lowest in the seven state region and only eight states in the country have a lower administrator to student ratio. This is importation information that can dissuade fair-minded legislators.

A few years ago, I could count on Republican legislators to assist me in preserving local control and pushing back against school consolidation and rural charter schools. However, legislation like these bills and the passage of SB 782 in 2015 raise questions about whether rural Oklahoma legislators are more interested in campaign contributions from charter and private school proponents than they are in serving constituents and the communities in their districts.

– David Perryman, a Chickasha Democrat, represents District 56 in the Oklahoma House