BY JOE DORMAN

There has been much discussion about the FY 2017 Oklahoma state budget. We heard the panic about doctor and nursing home provider rates being slashed to levels which could shut down Medicaid coverage in Oklahoma and close hospitals. We are about to see schools shift to four-day school weeks. We are still driving over terrible roads in our state causing double the national average repair costs for our vehicles.

There has been much discussion about the FY 2017 Oklahoma state budget. We heard the panic about doctor and nursing home provider rates being slashed to levels which could shut down Medicaid coverage in Oklahoma and close hospitals. We are about to see schools shift to four-day school weeks. We are still driving over terrible roads in our state causing double the national average repair costs for our vehicles.

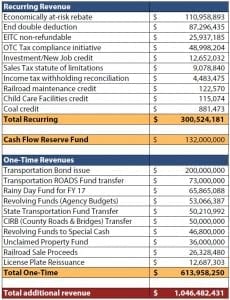

So, what did the politicians at the Capitol do with the budget? The FY 2017 budget passed in the final days of the session by a margin of 52 votes in the Oklahoma House, which has 71 Republican members. As you can see from the graphic, courtesy of the Oklahoma Policy Institute, there was quite a bit of creative accounting used to shape this budget.

The budget legislation reduced the $1.3 billion decrease in funding [the largest in state history] to a cut of $360 million [5%] less than the initial FY 2016 budget. So far, we have experienced three revenue shortfalls in the FY ‘16 budget, tying the previous record experienced from four other fiscal years. There is fear a record-setting fourth decrease might occur.

We have also seen four cycles of standstill corporate tax collections due to the state awarding credits and exemptions to various businesses.

The Legislature cannot appropriate more than 95% of certified funds for the upcoming year. This allows for a cushion in case of a revenue shortfall. If General Revenue Fund [GRF] revenue exceeds the 95% level, it flows into the Cash Flow Reserve Fund and can be appropriated in the future. The Legislature instead seized this estimated $132 million in the Cash Flow Reserve Fund for next year and used it this fiscal year. This leaves us with no funding from this source for next year, should there even be an increase in revenue.

Policymakers used about $66 million from the Rainy Day Fund, our state savings account.

Recurring revenue was gathered in the amount of about $300 million by eliminating various tax credit/exemption/waiver programs. Many of these helped Oklahoma’s working class. Others did make sense, such as the marginally-producing well credit.

The remaining $500 million came from one-time funding sources, which will not be available next year. This included shifting transportation trust dollars to the GRF and replacing with bond indebtedness.

Nothing moved forward in regards to stabilizing the budget with increased revenue. Eliminating the recent income tax cuts or putting the next reduction on hold was shot down by Gov. Fallin and legislative leaders. One tax increase was proposed which would have increased cigarette taxes, but it failed with bipartisan opposition. The sad part of this is the tax increase for the cigarettes could have triggered the next income tax cut, putting the state even further back in the next fiscal year.

As you can see, our state policymakers have not learned their lessons. Please demand more from those who you select with your vote on June 28 and Nov. 8.

– Joe Dorman served House District 65 as a state representative for 12 years and was the 2014 Democratic nominee for governor of Oklahoma. He is currently the Community Outreach Director for True Wireless.