According to the Oklahoma Education Association, Oklahoma will not use the extra funds in the budget this year to increase education funding. The reason? Much of the money is pandemic relief funds that won’t be coming into the treasury next year.

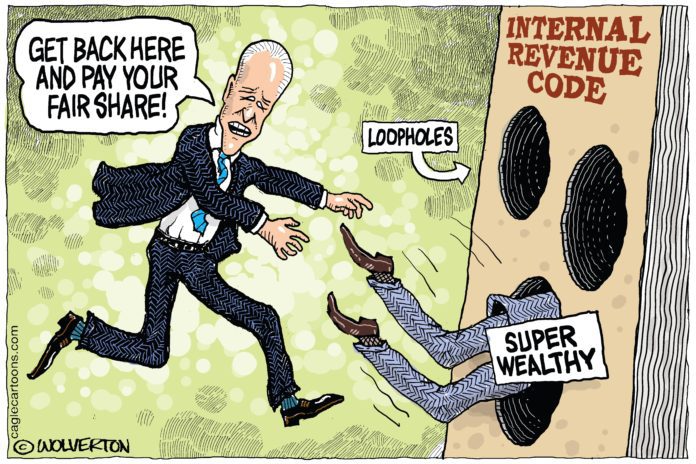

According to the Oklahoma Policy Institute, Oklahoma legislators are considering new tax cuts. Wait! Are they OK with using one-time funds to reward wealthy taxpayers?

Do the people who rah-rah for tax cuts understand that they only benefit a small portion of the taxpaying population?

Why do we pay taxes? There are the usual things we cite when asked:

– A modern, well-equipped military

– Well-trained law enforcement

– Safe roads and bridges

Then there are those that are considered more progressive:

– Clean air and water [Can you believe that’s considered progressive?]

– Universal access to health care

– Universal access to quality education

In the Ayn Rand universe, only those who build businesses, who have the ideas and the means to put them into action, deserve consideration. Everyone else is a taker.

In the real world, those with the ideas and the means cannot build their dreams without help, starting with roads and bridges to get their goods to market. They can’t manufacture goods without labor.

Labor needs the idea people, and the idea people need labor.

Businesses and manufacturers benefit when employees are well educated and have access to healthcare. We all benefit when we can rely on clean air and clean water. There is no one side. We are really all in this together.

I agree that continuous expenses shouldn’t be raised with one-time funds. One solution might be to raise taxes.

I adamantly oppose giving one side of the team one-time money, especially when both sides will pay with a loss of benefits.

It’s a fact that in the United States a handful of billionaires have hoarded more assets than the combined assets of the rest of us. So, until those who earn the majority of the income in this country pay their fair share, this country will not thrive. A strong GDP means nothing when many people can’t earn enough to even pay income taxes. That doesn’t stop the poor from being nickeled and dimed by local, state, and national taxes and fees. We all pay, but the poor pay a greater percentage of their income.

Until taxation is fair, Oklahoma will not be great. Until everyone pays their fair share, the United States won’t be great.