BY DAVID PERRYMAN

A few weeks ago a friend from church asked me about the recurring budget problem that we have in Oklahoma. Like most Oklahomans, he said that he would really like to have three or four things fixed.

A few weeks ago a friend from church asked me about the recurring budget problem that we have in Oklahoma. Like most Oklahomans, he said that he would really like to have three or four things fixed.

He asked me to help get teachers a pay raise and to vote for a plan that would allow Oklahomans to be able to use their drivers’ license to fly on an airplane. He also said that he wanted us to have good, safe roads and bridges.

Our conversation was pretty similar to many that I have had over the past couple of years. But as I spoke to him, I asked him what he thought about the revenue coming into the state and whether his state income taxes or property taxes were too high. He said that his big gripe was with federal income taxes; but that he had never been too concerned about state income taxes and that he knew that his property taxes were a lot lower than property taxes in other states.

When I asked if he realized that he was paying less in state income taxes than he did in 2004, he said that he had not noticed any savings. I went home and pulled out a paper that showed that over the past 12 years, Oklahoma’s top income tax rate had been cut from 6.65% to 5% and that it could fall to 4.85% as early as next year.

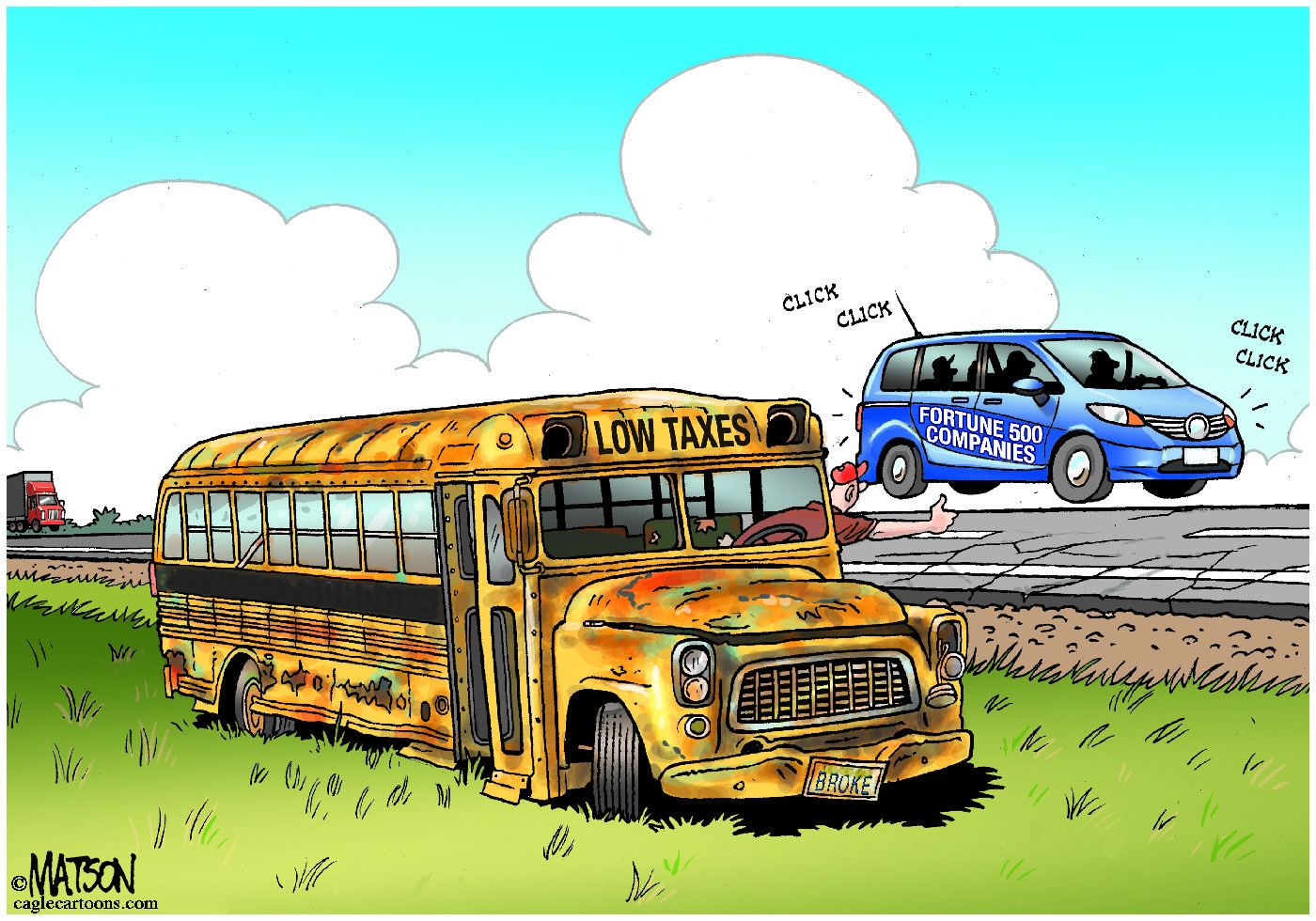

That same paper showed that the annual lost state revenue because of cuts to the top personal income tax rate enacted since 2005 is $1.022 billion per year, according to an analysis conducted for Oklahoma Policy Institute by the Institute on Taxation and Economic Policy [ITEP], a non-partisan national research organization.

So it seems like more than a coincidence that Oklahoma is facing a budget hole of nearly $1 billion when the income tax cuts have cost our state just over $1 billion.

Imagine my surprise when Gov. Fallin unveiled her new plan to address that hole in her State of the State address! She would like to do away with the state income tax and the state’s 4.5% sales tax rate on groceries. In return, she would increase taxes by nearly $2.6 billion by raising our gasoline tax by up to 10 cents per gallon, adding $1.50 to the cost of a pack of cigarettes and have you pay a 4.5% tax on a myriad of things that currently cost you a whole lot more than you spend on groceries.

For instance, some of the 164 types of services and things that you will now be paying at least four cents per dollar on are: utility bills such as gas, water, electricity, sewer and trash; car washes; mowing and yard work; day care services; laundry and cleaners; doctor, dentist and optometrist visits; nursing home, home health care and skilled nursing services; dialysis and hospital bills; cemetery lots; funeral expenses; life, health, accident and property insurance; abstracts and realtor fees; legal fees; tax preparation and surveying; banking, mortgage, lending and deposits; pension, health and welfare funds; automobile lease payments and haircuts and styling salons.

Wouldn’t it be simpler just to restore the top income tax rate to 6.65% and stop robbing Peter to pay Paul?

– David Perryman, a Chickasha Democrat, represents District 56 in the Oklahoma House