BY FROMA HARROP

You’d think that with stocks still up for the year and the new tax law smiling on big earners, the financial community would be gung-ho for Donald Trump and congressional Republicans. But it’s not. For the first time in a good while, Wall Street is giving more in direct donations to Democrats than Republicans.

You’d think that with stocks still up for the year and the new tax law smiling on big earners, the financial community would be gung-ho for Donald Trump and congressional Republicans. But it’s not. For the first time in a good while, Wall Street is giving more in direct donations to Democrats than Republicans.

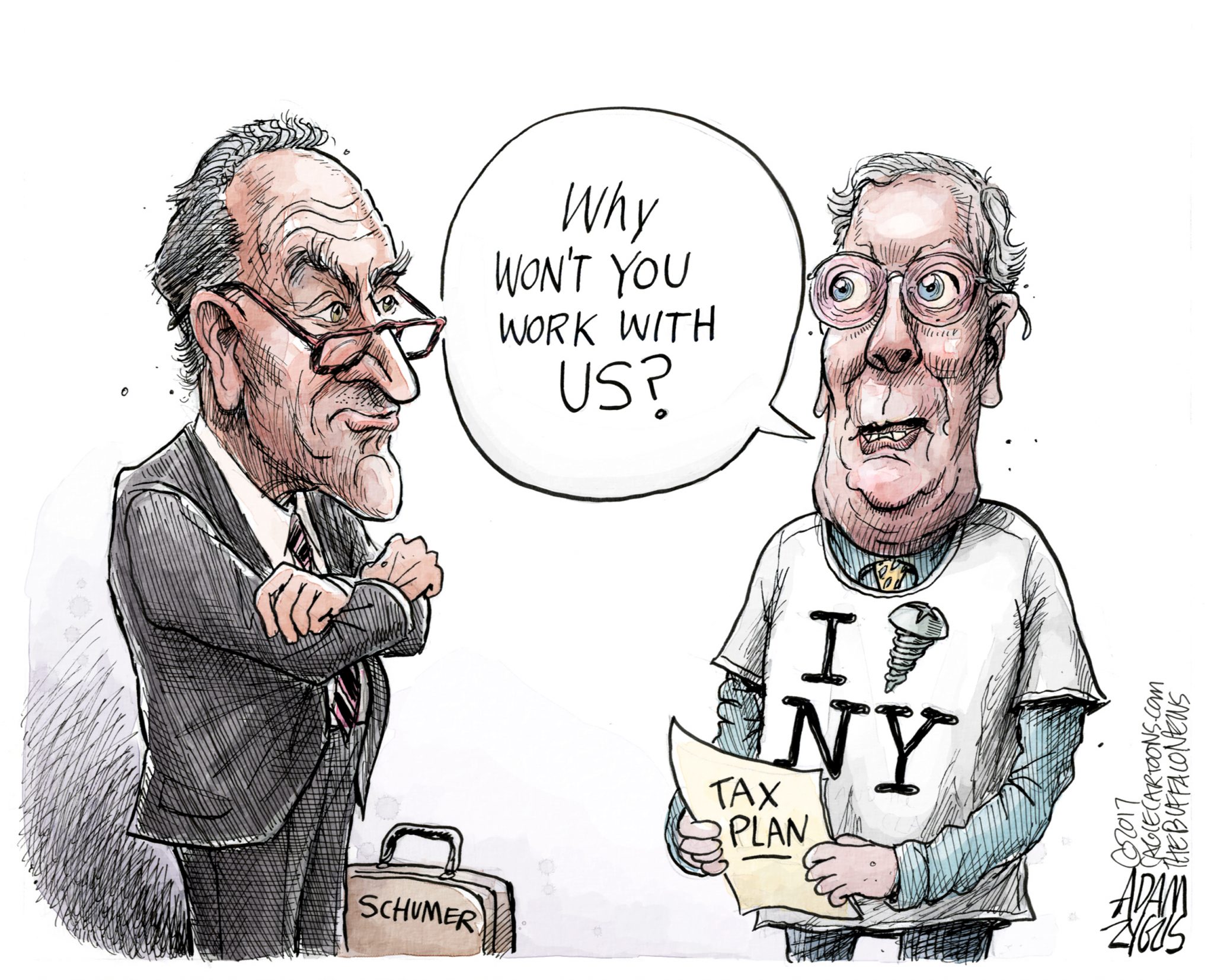

And here’s a big reason: The new tax law purposely punishes people in the expensive-to-live-in blue states, which is where Wall Street people live. To them, this is not just about money. It’s personal.

At issue is the $10,000 cap on what taxpayers may deduct for state and local taxes. In the New York, Connecticut and New Jersey suburbs, property taxes alone can easily exceed $10,000. Then there are state and local taxes.

Until 2016, Finn Wentworth, a real estate mogul and executive for the New York Yankees, raised money for the Republican National Committee. He’s now raising hundreds of thousands for Mikie Sherrill, a Democrat vying for an open House seat in an affluent northern New Jersey district. A former Navy helicopter pilot, she faces Republican Assemblyman Jay Webber.

The Republicans’ fleecing of his region displeases Wentworth greatly. “It was almost like the New York metropolitan area – we had a target on our back,” he was quoted as saying.

Let us count the ways limiting this deduction is unfair. First off, the federal government will now be taxing income already taxed by states, cities and towns.

The high taxes reflect the high cost of living. Thus, public employees – teachers, police, firefighters – must be paid more than elsewhere, and that expense must be tacked onto state and local tax bills.

Speaking of which, decidedly middle-class people also get sucker-punched by this tax on their taxes. In Long Island’s Nassau County, where a good chunk of the New York City police force resides, the average property tax alone exceeds $11,000.

This attack on blue states is the handiwork of Southern and rural politicians intent on making taxpayers in mostly Democratic regions bear more of the nation’s tax burden. Keep in mind that the income tax is already a blue state tax. The federal tax code treats a $110,000 income in super-expensive San Francisco the same as a $110,000 income in highly affordable El Paso.

In 2016, New York state sent about $41 billion more in tax revenues to Washington than it got back in federal spending, the 47th-worst deal in the country. New Jersey ranked 50th. Now we can expect the imbalance to get worse.

There is a potential remedy, and it is to replace the Republican Congress with a Democratic one. The Democrats need to gain 24 seats in the midterms to take over the House. There are now 37 Republican-held seats in the high-tax blue states of California, New York, New Jersey, Illinois and Maryland. Their voters tend to be especially sensitive to taxes.

It matters not that some Republicans, such as Rep. Leonard Lance of New Jersey, voted against the tax bill. His presence helps maintain the Republican majority that made it happen. As his Democratic opponent, Tom Malinowski, put it, “there is precisely 0.0% chance [the deduction] will be restored if we send Congressman Lance back to Washington to vote for the same GOP leadership that passed the tax bill and will defend it to its dying political day.”

An ad now saturating the region shows Sherrill flying a helicopter and shouting over the whir, “I’ll fight to restore your tax deduction, and Jay Webber won’t.”

Did Republicans in Washington really think that they could stick it to the blue states with no consequences? If they did, they might think otherwise after Nov. 6.

– Froma Harrop’s columns appear regularly in The Oklahoma Observer

Creators.com