Shady investors are rigging the economy to get rich by making your life more expensive.

It’s called private equity.

Private equity firms are privately owned financial organizations. Here’s how they make money: they buy struggling companies with borrowed money, often using the companies’ assets as collateral for the loans. They then make the purchased company profitable by cutting wages, outsourcing jobs, and stripping assets. Then they resell what’s left of the company, often laden with debt, and pocket the returns.

Private equity managers have their tentacles in so many industries that they touch almost every part of your life without you even knowing it. These are just a few:

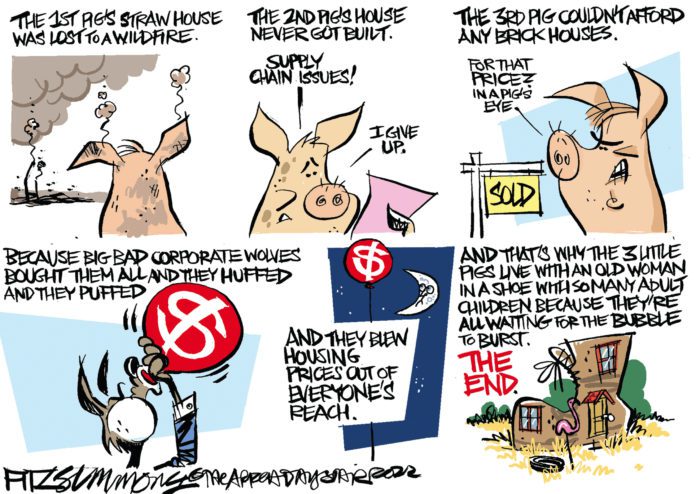

First, housing.

Private equity has a hand in today’s skyrocketing housing costs. Private equity-backed real estate corporations are buying up both single-family homes and apartment buildings at record rates. In 2021, private equity investors bought nearly one in seven homes in the country’s top metro areas, and private equity-backed corporations now own at least 260,000 homes across the country.

It’s a lucrative business. Blackstone, one of the largest private equity firms in the world, made a cool $7 billion when it sold off its shares of the rental company it created, Invitation Homes – more than double what it initially invested.

So what happens when your landlord becomes a private equity firm?

Higher rent. Faster evictions. Punitive fees. Shoddier repairs and services, if anyone even shows up at all.

Even if your building isn’t owned by a private equity firm, their impact on the market is probably driving your rent up.

When corporate landlords gobble up already-scarce homes, they shut out millions of people from being able to buy their own homes, preventing them from building financial stability and generational wealth. In essence, it’s a direct transfer of wealth from the middle and working class into the pockets of private equity managers.

Next, healthcare.

Over the past two decades, private equity in healthcare has exploded from $5 billion to over $100 billion a year, from buying hospitals to staffing emergency rooms to taking over nursing homes.

TeamHealth, a staffing agency owned by Blackstone, charges about six times what Medicare charges in emergency rooms. TeamHealth and Envision, another private equity-owned physician staffing firm, are notorious for their use of surprise medical bills. Don’t you just love surprise bills? TeamHealth and Envision doctors aren’t covered by insurance, so when a patient goes to an in-network hospital but is seen by a private equity doctor, the patient gets stuck with a surprise out-of-network bill.

Beyond eye-popping costs and surprise bills, patients can also expect lower quality care. A sweeping study examined private equity-owned nursing homes and found dire effects: staff hours were slashed, jobs disappeared, and the use of antipsychotic medications – which have a host of dangerous side effects – skyrocketed. All this contributed to a 10% increase in patient mortality. That’s more than 1,000 lives lost every year on average.

If private equity is doing so much damage, how come it isn’t the front page story on every paper in the country? Well, for starters, hedge funds and private equity firms own half the nation’s daily papers. And about a quarter of U.S. newspapers – over 2,000 publications – have shut down over the past decade and a half.

The result? Reporters, staff, and readers lose – while private equity managers get even richer.

A 2022 study found that after private equity buyouts, the number of reporters and editors declined by nearly 10% each. The East Bay Times in Oakland, CA, owned by Alden Global Capital, laid off 20 employees just one week after the paper won a Pulitzer Prize.

Declines in local news coverage are associated with lower voter turnout, less competitive local elections, and more government corruption. Even as jobs and hours are cut, subscription prices are jacked up – sticking readers with a lower-quality product for a much higher cost.

So what can be done? First and foremost, close the industry’s favorite tax loophole that enables private equity managers to keep their taxes low. The carried interest loophole treats their personal income as capital gains, taxed at a top rate of just 20%, instead of the personal income it actually is, with a top tax rate of 37%. It’s yet another way private equity is looting America.

The pattern is clear. When private equity gets involved, costs get higher and quality gets lower – while the rich get richer. It’s past time for Congress to rein in this predatory industry.