BY SHARON MARTIN

If you have a strong lobby and money to contribute to political campaigns, there is probably a tax break with your name on it. Or a subsidy.

If you have a strong lobby and money to contribute to political campaigns, there is probably a tax break with your name on it. Or a subsidy.

The federal income tax code, Title 26 of the United States Code, is massive. There’s no doubt that it needs some reworking.

Alas, the people with time and money to come up with new tax plans probably don’t have the interest of the average taxpayer in mind.

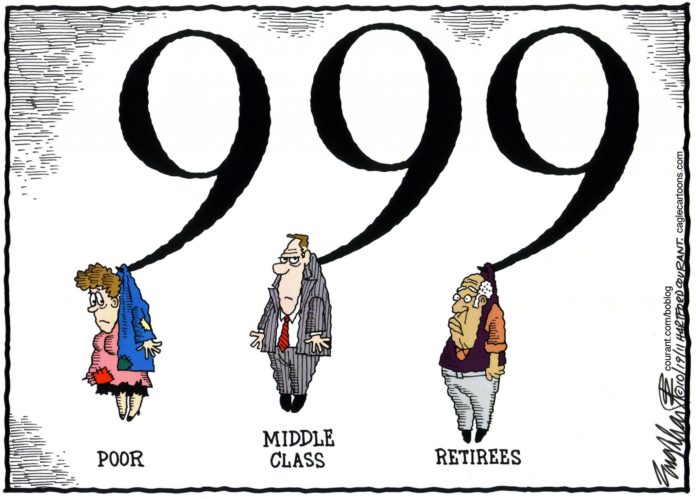

Take Herman Cain’s 9-9-9 Plan for example. You like the simplicity of it, but you need to consider what it will cost you. According to Economist Jared Bernstein, unless you are in the top 20% of earners, you will pay more.

Citizens in the bottom 20% will pay almost $2,000 more in annual taxes. Those in the middle 60% will pay $4,000 more each year, plus or minus a couple hundred dollars. If you are in the top 20%, however, you’ll pay an average of $14,000 less.

Averages are misleading when the outliers are figured in. The outliers, in this case, are the top 1%. They will pay an average of $238,422 less. So, unless you are in the top 1% of earners, you’d better see your accountant before you buy into this plan.

Maybe you’re OK with giving new tax breaks to the top 1% percent. Maybe, like John Steinbeck says, you don’t see yourselves as part of the 99% but as “temporarily embarrassed millionaires.”

Taxes will always be contested. But if we want services, we have to pay for them. And if we want some measure of fairness, we have to have a progressive tax code.

For those who invoke the founding fathers, Thomas Jefferson explained it this way in a letter to James Madison: “I am conscious that an equal division of property is impracticable. But the consequences of this enormous inequality producing so much misery to the bulk of mankind, legislators cannot invent too many devices for subdividing property … ”

Jefferson proposed that we “exempt all from taxation below a certain point, and to tax the higher portions of property in geometrical progression as they rise.”

Why?

Because, “Whenever there is in any country, uncultivated lands and unemployed poor, it is clear that the laws of property have been so far extended as to violate natural right. The earth is given as a common stock for man to labor and live on.”

Thomas Jefferson understood the math.

– Sharon Martin lives in Oilton, OK and is a regular contributor to The Oklahoma Observer