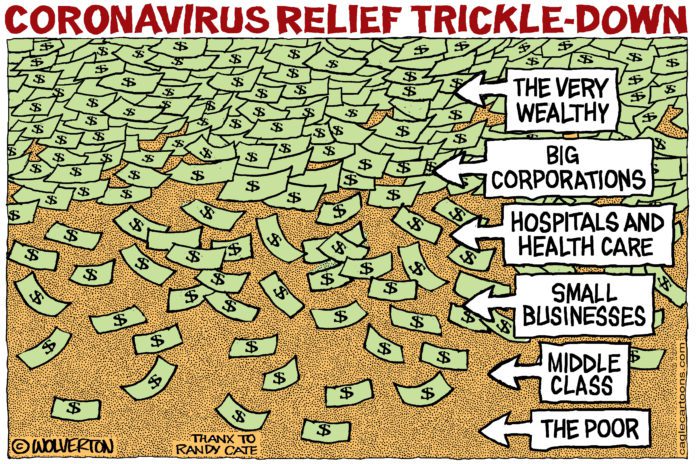

Where has all the money from the $2.2 trillion CARES Act gone?

American taxpayers who qualified received $1,200. Some small businesses were able to secure SBA Paycheck Protection Program loans. Too much of that forgivable loan money seems to have slipped into deep pockets, including those of the DeVos and Kushner families.

Months later, in Oklahoma and elsewhere, those unemployed by the pandemic are still trying to get their unemployment and stave off eviction. Food pantries are feeding their families, largely from private donations.

Meanwhile, the Dow Jones is in record territory. How is this possible?

This smells like corruption, but even if this is just legal stink, it isn’t good policy.

If you want the economy to thrive, those at the bottom of the system need enough to pay rent and buy food. They need to be able to access healthcare, including mental health care. It’s not a giveaway. Their money goes back into the system.

Most of the money given to billionaires, whether in the form of government contracts or tax breaks, is hoarded. They find all sorts of ways to stash the cash, a lot of it courtesy of taxpayers.

Privatization is just another scheme to rob taxpayers. Whether it is Gov. Kevin Stitt giving CARES Act funds to send public school students to private schools or Louis DeJoy helping the GOP destroy the post office in favor of shipping companies, that is public money flowing up into private pockets.

I believe in private schools. If parents can afford to send their kids there, or if scholarships not funded with taxes are available, they can be the right choice for some students. But taxpayers shouldn’t fund private schools. Public money should be spent making public schools the best schools in the country.

The Payroll Tax Cut that the president wants to make permanent will save employers money at the expense of retirees. It’s another tax cut for businesses and another loss for taxpayers, including those who paid into the insurance program for years.

Who will feed and house the old folk when Social Security is no more?

Tax breaks should not be the reward for campaign donations.

Public funds supporting the public funders, taxpayers, shouldn’t be a partisan issue. We all pay taxes, from the homeless man who pays sales tax on a scrounged $20 to the low-wage worker who pays gasoline tax to get to work to the truck drivers and school teachers and sales clerks to all of us funding Social Security.

If your legislator is more concerned with corporate profits than he or she is with the wellbeing of citizens they swear to protect, vote them out. If this country’s economy is going to thrive, taxpayer money must work for taxpayers.

It’s not just a humanitarian issue; it’s sound economic policy.

Money doesn’t trickle down. It runs uphill.