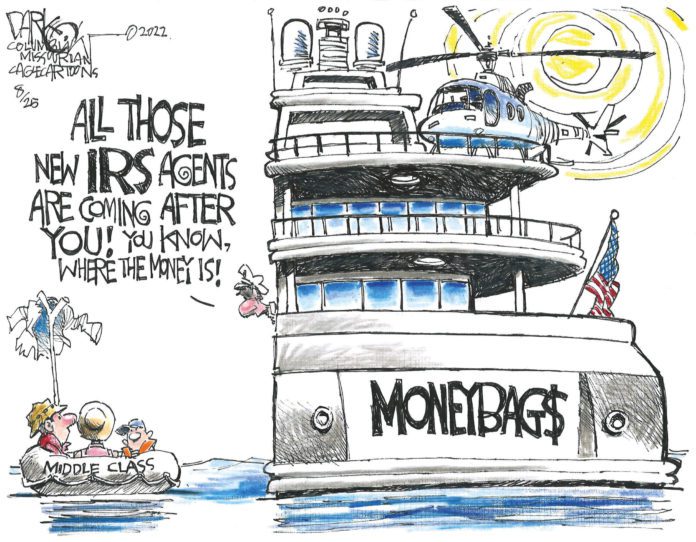

U.S. Rep. Markwayne Mullin announced on Twitter that he was joining a bill to block funding to the IRS to “hire new agents to increase audits on hard-working Americans.”

First, most hardworking Americans have little to fear from audits. Some of the hardest working Americans I know make too little to pay income taxes, and they welcome the new agents if it means they can get a timely refund. Second, if you’re at all interested in cutting the deficit, wealthy tax cheats should be held to account.

Nobody likes paying taxes, but neither do we want to do without the things that taxes provide – public schools, public roads, public safety, and the postal service, for starters.

On a trip to India more than a decade ago, I saw the stark reminder of the importance of public education. Middle class students in school uniforms walked with their friends, secure that they had a future ahead of them. The poorest kids, in rags, begged on the streets.

Now, imagine a tax-free country, where everyone is on their own. Already, citizens here struggle to pay for healthcare. The cost of childcare keeps caregivers out of the job market. Schools funded by ad valorem taxes provide for well-funded schools in wealthy communities and struggling schools in poorer communities.

Our country has the highest medical costs among wealthy nations, and the poorest medical outcomes. Imagine if we provided preventive medical care to everyone. Wouldn’t it be cheaper to tax us and provide universal coverage? I know the outcomes would be better.

Healthier citizens create a healthier economy.

Just as taxes are necessary, so is a fair taxation system. If the wealthy don’t pay their fair share because of all the gimmicks their lobbyists secure for them, the equality gap widens. This affects not only the economy but the security of the country. There is nothing as dangerous as a citizen with nothing left to lose.

Congressman Mullin, government spending is essential. Can we do a better job of targeting essential public services? Yes. But protecting tax cheats and delaying tax refunds won’t do the trick. If you really want to protect hardworking Americans, you’ll make sure the IRS can do its job.

Editor’s Note: When elected 10 years ago, Mullin promised to serve only three terms in Congress. Now completing his fifth term, he is asking Oklahoma voters for a promotion: to succeed Oklahoma’s retiring U.S. Sen. Jim Inhofe. Mullin’s Democratic opponent is former 5th District U.S. Rep. Kendra Horn.