BY DAVID PERRYMAN

Set in 1922, Thoroughly Modern Millie features Julie Andrews as Millie Dilmount who hails from Salina, KS, and heads to New York City with the “thoroughly modern” idea of finding a wealthy husband. Neither love nor longterm consequences “interfered” with Millie’s plan and singular goal of wealth and social status through matrimony.

Set in 1922, Thoroughly Modern Millie features Julie Andrews as Millie Dilmount who hails from Salina, KS, and heads to New York City with the “thoroughly modern” idea of finding a wealthy husband. Neither love nor longterm consequences “interfered” with Millie’s plan and singular goal of wealth and social status through matrimony.

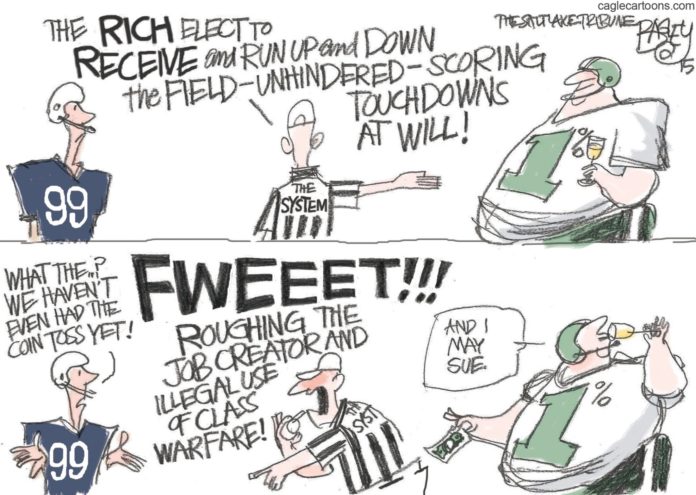

Not unlike Millie, Oklahoma leaders have betrothed themselves to billionaire and multi-millionaire corporations, promising tax cuts, tax credits and tax rebates in return for campaign contributions, junkets and future corporate board positions and have sacrificed the health and education of our citizens, allowed our roads, bridges and other infrastructure to crumble and failed to protect the earning capacity of hard working Oklahomans.

The “revenue failure” that we are currently experiencing means that state revenue is too low to meet the state’s obligations under the 2016 Budget. In addition to this budget year, we will be facing at least a $1.3 billion budget hole next year.

These budget problems did not occur overnight. According to a November 2014 article in Oklahoma Watch, Oklahoma has more than 400 corporate tax credits, subsidies and direct payments with the 24 largest paying out more than $750 million per year. An August 2014 Tulsa World article mentioned that the New York Times had reported that Oklahoma was responsible for about $2 billion in incentives that year. In two of the past three months, the Oklahoma Tax Commission has paid out more in corporate rebates and credits than it received in corporate income tax, making these subsidies unsustainable.

Last session I co-authored HB 2182, the Incentive Evaluation Act, which established a bipartisan commission to evaluating all state tax credits. I had hoped that the study would produce recommendations before this year’s session.

However, Gov. Mary Fallin failed to make the required appointment to the commission and Senate President Pro Tem Brian Bingman, R-Sapulpa, delayed in the appointment of a member until about two weeks ago. These delays mean that the subsidies will continue.

Another reason for our situation is that, according to the Oklahoma Policy Institute, state income tax cuts since 2005 have decreased annual state revenue by $1.022 billion, but have only given median Oklahoma households an income tax cut of $19 per month. I joined several legislators in asking the governor to delay the Jan. 1, 2016 income tax cut, but instead, she left it in place and is looking at ways to increase sales tax revenue through the elimination of sales tax exemptions and taxing more types of sales.

Gov. Fallin calls this “modernizing the way sales tax is collected” and in her State of the State address said that she hoped to increase sales tax revenue by $280 million.

Oklahomans should watch this very carefully.

She wants the Legislature to help her find $80 million by eliminating sales tax exemptions. The current list of sales tax exemptions includes purchases by churches and non-profits, merchants, tuition, rural electric cooperatives, farmers, disabled veterans and cities, towns and schools as well as things purchased for resale.

She is looking for the other $200 million to be increased revenue from sales taxes that will be imposed on things that are not currently taxed. A list of transactions that do not currently have sales taxes added are things like veterinary services, residential water, electricity, sewer and natural gas, insurance services, abstracts, bank service charges, haircuts and laundry services, tax preparation, advertising, carwashes, towing, professional services, surveying and labor charges.

It may be “thoroughly modern” to shift the tax burden from corporations to hardworking families by increasing sales tax revenue but it seems to be far from fair unless income tax cuts, credits and incentives are reviewed also.

– David Perryman, a Chickasha Democrat, represents District 56 in the Oklahoma House