BY MARY FRANCIS

The blunt facts are well known – every day we delay, another 18 million tons of CO2 are released into the atmosphere, and most will remain there for about a century warming and warming and warming the earth. Furthermore, with every year of inaction, the carbon reductions we will need in order to deal successfully with the coming climate chaos are becoming larger and much harder to achieve.

The process of producing goods and services – including electricity – puts carbon dioxide into our atmosphere which generates huge costs on society. But the producers of those goods and services don’t pay those costs. The health and environmental costs are external to the corporations. That simply means citizens pay them with tax dollars.

The goal of our public policy toward climate change should be to put those costs back onto the parties responsible for carbon emissions. In short, we must “put a price” on carbon, which will create powerful incentives to emit less of it.

Do you want to get the attention of America’s CEOs and their boards of directors? Want them to change their ways? The surest answer is simple – focus where they focus – on their bottom line.

Do you want Americans to consume less high-carbon energy? Then steadily raise the price of goods and services that are produced with high-carbon fuels. Eventually, everyone [except perhaps the wealthiest or mentally deficient] will start to conserve and switch to low-carbon energy alternatives.

“Why not ‘cap-and-trade?’” you ask. Because cap-and-trade has historically and quickly been turned into “cap-and-evade” by the big corporations.

The only effective way to begin reducing greenhouse gas emissions and slow global climate change is to make it more expensive to emit carbon dioxide. Cap-and-trade also leaves the size of the reduction less certain. In contrast, a gradually rising tax on emissions gives businesses and consumers certainty about costs.

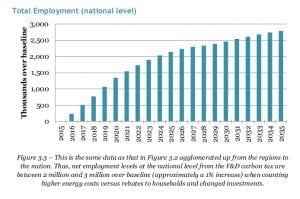

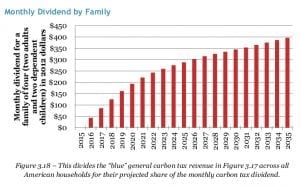

Providing a 100% dividend to Americans is the surest way to win support – both from conservatives and the 65% who will get more dollars back than the calculated increase in utility costs according to a REMI economic study.

What penalty do we pay if it doesn’t work? We and future generations get cleaner air, less asthma, reduced mercury poisoning of fish and our children, fewer pulmonary diseases, water that doesn’t catch on fire and a monthly check.

So how do we protect our American industries from unfair competition in the global marketplace?

If you are a believer in the market system as the most efficient way to allocate resources, then you will be interested in the Citizen’s Climate Lobby border adjustment. The World Trade Organization has said that if we tax our own industries, then we can do an equivalent tax on foreign country’s fossil fuels and goods as they come across our border.

If you were China or Venezuela, would you rather pay the Americans a border fee or collect the money yourself? This border adjustment will make the carbon tax “go global” out of self-defense and, of course, a global climate problem must have a global solution.

The Carbon Fee and Dividend plan was developed by the Citizen’s Climate Lobby which last year visited 503 members of Congress in Washington, DC. The local chapter, CCL Norman, regularly attends the national CCL conferences, as well as the local town halls. At last August’s town hall meeting in Norman, in response to a question from Norman CCL leader Kathy Rand, U.S. Rep. Tom Cole said, “I don’t think there is any doubt there is climate change – I think the science is pretty clear. We can debate over how to deal with it.”

Recognizing the problem is the first step. Now it’s time to get started on the solution.

– Norman resident Mary Francis is a Citizen’s Climate Lobby member and retired educator

Editor’s Note: The graphs below by REMI show the yearly increase in the dividend and the additional jobs created above the number expected without CF&D.