BY SHARON MARTIN

We’re among the leaders in job growth. Our unemployment rate is below the national average. We’re a state that President Obama should look to if he wants to fix the nation’s economy.

Unless you’re a National Board Certified Teacher who lost a big chunk of your income, things are just ducky. Unless you are one of the nearly 227,000 children living in poverty in Oklahoma, life is good. And Gov. Fallin wants to make things even better.

“I’m asking our lawmakers to join me in an ambitious and exciting undertaking,” she said in her State of the State address last week.

The governor says that “the State Emergency Fund is nearly empty and has a large backlog of several years of expenses,” and our “state Capitol building is currently in a state of disrepair.” The Oklahoma Highway Patrol is understaffed, DHS shelters are overcrowded, and bridges are unsafe, but the governor has a plan. She wants to eliminate the state’s main source of revenue.

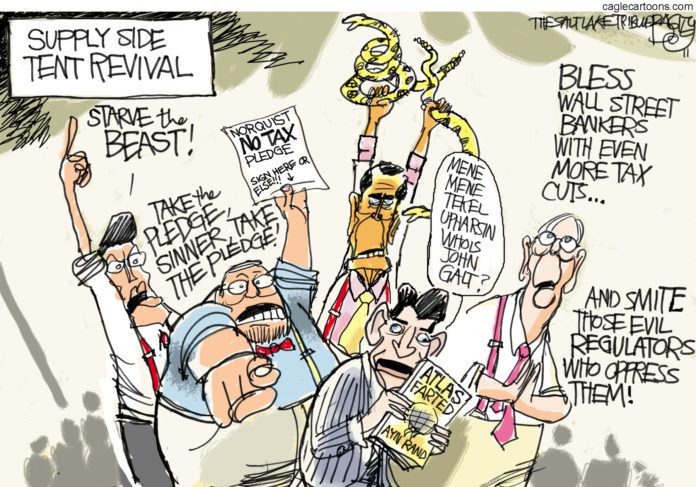

“The Oklahoma Tax Reduction and Simplification Act will immediately cut income taxes for Oklahomans in all tax brackets, simplify the tax code, and chart a course towards the gradual elimination of the income tax.”

In 2011, the state collected $2.1 billion in income tax and $1.7 billion in sales and use taxes. Can we get by on half rations? Not to worry. Businesses will be so attracted to our state that increased revenue from job growth will make up any shortfalls.

And there are ways of replacing income tax revenue. In 2011, the governor requested and received an increase in fees, licenses, and permits to the tune of $49.3 million. Call this a hidden tax. A similar amount was raised by repealing the income tax credit for capital investment in rural businesses, a hit to small business owners where jobs are sorely needed. Another $11 million came by taxing federal tax debt forgiveness.

The easiest way to replace the lost revenue is to shift the burden from the rich to the poor by increasing sales taxes. The less you earn, the higher the percentage of your income will be spent on taxes. Alas, the poor don’t contribute big bucks to political campaigns, so their higher tax rate isn’t a problem.

We’ll cut budgets and tax the poor. That’s the plan. For the needy in Oklahoma, life is going to get even harder. For those who have plenty, the state of the state is strong.

– Sharon Martin lives in Oilton, OK and is a regular contributor to The Oklahoma Observer