BY DAVID PERRYMAN

Charles Caleb Colton was a colorful guy. First a member of the clergy, spending 20 years with the Church of England between Devon and London, he was known as a gifted clergyman with an “eccentric, indulgent disposition.”

Charles Caleb Colton was a colorful guy. First a member of the clergy, spending 20 years with the Church of England between Devon and London, he was known as a gifted clergyman with an “eccentric, indulgent disposition.”

His eccentricity led him to a life of writing, gambling and wine collecting. His role as a cleric was cut short when allegations arose that he was a “wine merchant” and he fled to the United States where he wandered the American countryside for a couple of years in the mid-1820s.

Colton was supposedly an incurable gossip whose most famous work was “Many Things in a Few Words,” a scathing account of history’s political and religious leaders.

For all his antics, Colton’s most famous quotation – “Imitation is the sincerest form of flattery” – is particularly relevant as Oklahomans observe the policies and economic theories that both state and federal elected officials are moving toward.

It seemingly began in Kansas as the tax rate for many businesses in Kansas was dropped to zero and the individual income tax rate on high wage earners was cut from 6.4% to 4.9%. As a result of those cuts, Kansas’ revenues decreased by more than $650 million, causing schools to go to part time instruction, road repair projects to be delayed and programs for poor children, disabled and elderly residents to be reduced.

The theory was that these tax cuts would stimulate the Kansas economy and thereby pay for the tax cuts. They didn’t.

Not to be outdone, Oklahoma reduced income taxes from 7% to 5% and cut gross production taxes on oil and gas produced in Oklahoma from 7% to 2%, decreasing Oklahoma’s revenue by more than $1.2 billion per year.

Consequently, scores of Oklahoma schools are on four-day weeks, cuts to health care providers have closed hospitals and ambulance services, and developmentally disabled programs are at risk as are nutrition programs in schools and senior centers.

The theory was that these tax cuts would stimulate the Oklahoma economy and thereby pay for the tax cuts. They didn’t.

Gov. Mary Fallin refused to allow thousands of low income working Oklahomans access to health care coverage through Medicaid, even though their employers do not provide health insurance coverage. Essential state programs have been cut. The devastation caused to the rural health care industry has put Oklahoma’s rural economy into a tailspin.

Agency budgets have been slashed as a result of these irresponsible cuts and now instead of reversing tax cuts on the oil and gas industry and high income earners, the speaker of the House and the governor fiddle while Rome burns.

Fortunately, there are other federal funds that provide health care and nutrition for children of impoverished families and for aged and disabled citizens – the last vestige of hope that many have. In fact, Oklahoma relies on the federal government for more than one-third of its budget.

Oklahomans whose lives depend upon the federal government may soon be in double jeopardy.

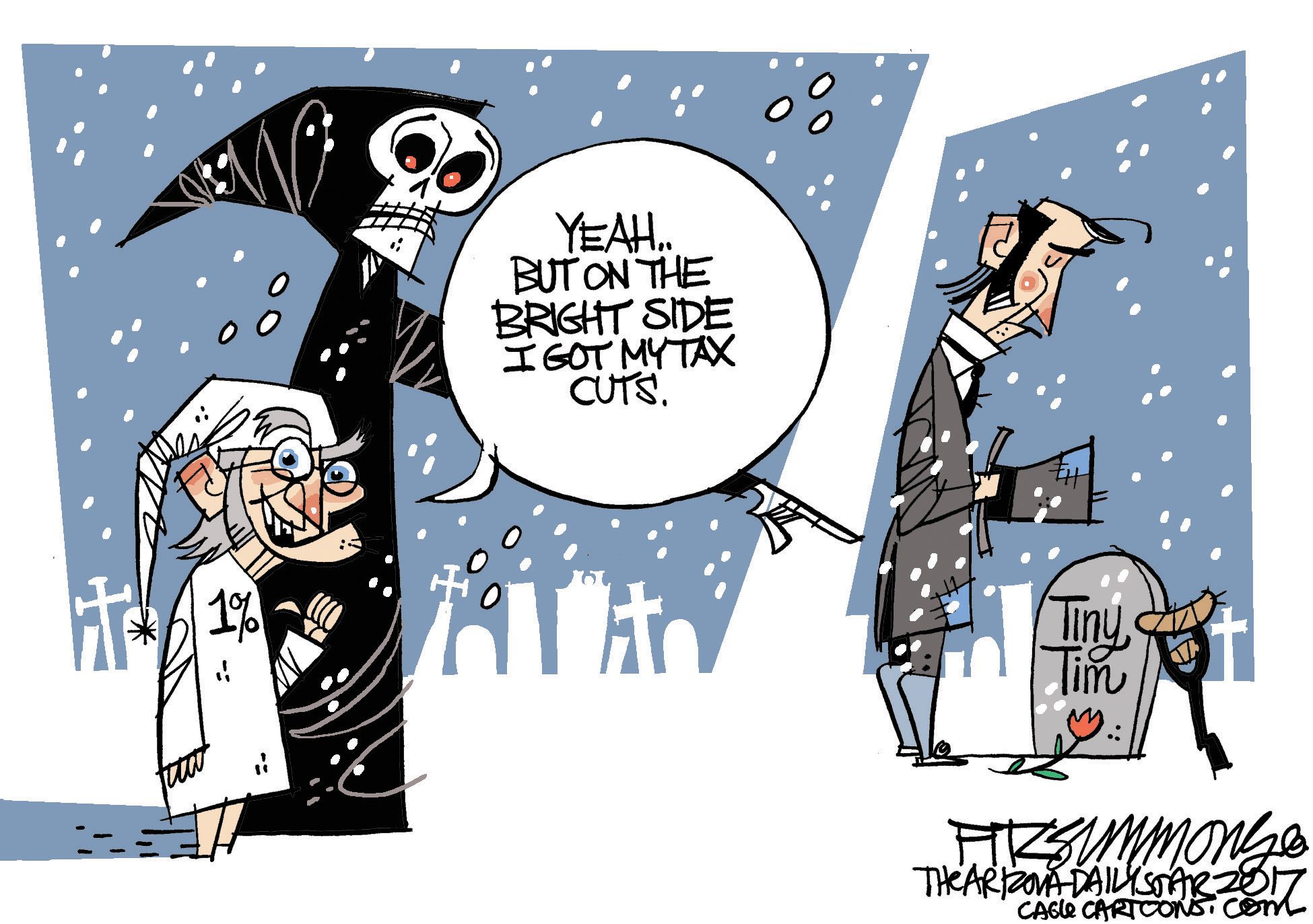

Despite the abject failures in Kansas and Oklahoma, a move now exists in Washington, DC to “stimulate the economy” by cutting taxes on high income earners so that the money that is placed in the hands of corporations will “trickle down” to the middle class. Sound familiar?

With a super-heated stock market showing corporate valuation at an all-time high and corporations sitting on billions of dollars of capital, are they the ones who need a tax break to stimulate our economy? It would seem that consumers whose wages have been stagnate and purchasing power has been sliding for the past 40 years ought to be receiving the stimulation.

Oklahoma’s tax cuts have been used to justify cuts to services and benefits. When the federal government follows suit and uses decreased revenue as the basis for privatizing Social Security, turning Medicare and Medicaid into block grants, and dismantling nutrition and infrastructure programs, Oklahomans will have no place to turn.

While Charles Caleb Colton said “imitation is the sincerest form of flattery,” he only had it half right. Oscar Wilde made the more astute statement when he said, “Imitation is the sincerest form of flattery that mediocrity can pay to greatness.”

– David Perryman, a Chickasha Democrat, represents District 56 in the Oklahoma House